The new wage code proposed in the parliament has been approved. Soon it will be implemented across the country as the majority of the states are all set for implementation. These changes are the attempt by the government of India to simplify the regulation of the wages and extend security to the people working in the unorganised sectors as well.

The New Wage Code Act has made changes in the percentage of the basic pay from the total cost to the company. That directly alters various components of the salary structure such as taxes, provident fund contribution and gratuity for private-sector employees. Resulting in a lesser take-home salary.

The major change in the new wage code that impact the payroll significantly is the definition of ‘wage’. According to the new definition, the ‘wages’ or the basic salary of the employee cannot be less than 50% of the total cost to the company.

Let’s have a detailed view of how this new wage code impacts the Indian payroll.

What’s Different in The New Wage Code?

Definition for ‘Wages’

Our current labour codes have multiple definitions of ‘wages’ while the new labour codes give us a single definition. Due to the single definition, there is an increase in understanding of related components too. Doing payroll according to the new unified definition under the wage code will also reduce confusion.

Greater Clarity

Various inclusion and exclusions are well stated in the code under the definition of ‘wages’. To stay compliant with the wage code, companies will have to analyse as well as restructure the current payroll.

Wider scope

Companies do not have to wonder if the code will apply to their employees or not. Due to the wider scope, the protection under the new wage code will be given to employees in organised as well as unorganised sectors in India.

F&F Settlement

According to the new wage code, all the wages payable will have to be paid within two days of resignation or removal of the employee. Companies have to make the necessary changes in their payroll and related processes to achieve that.

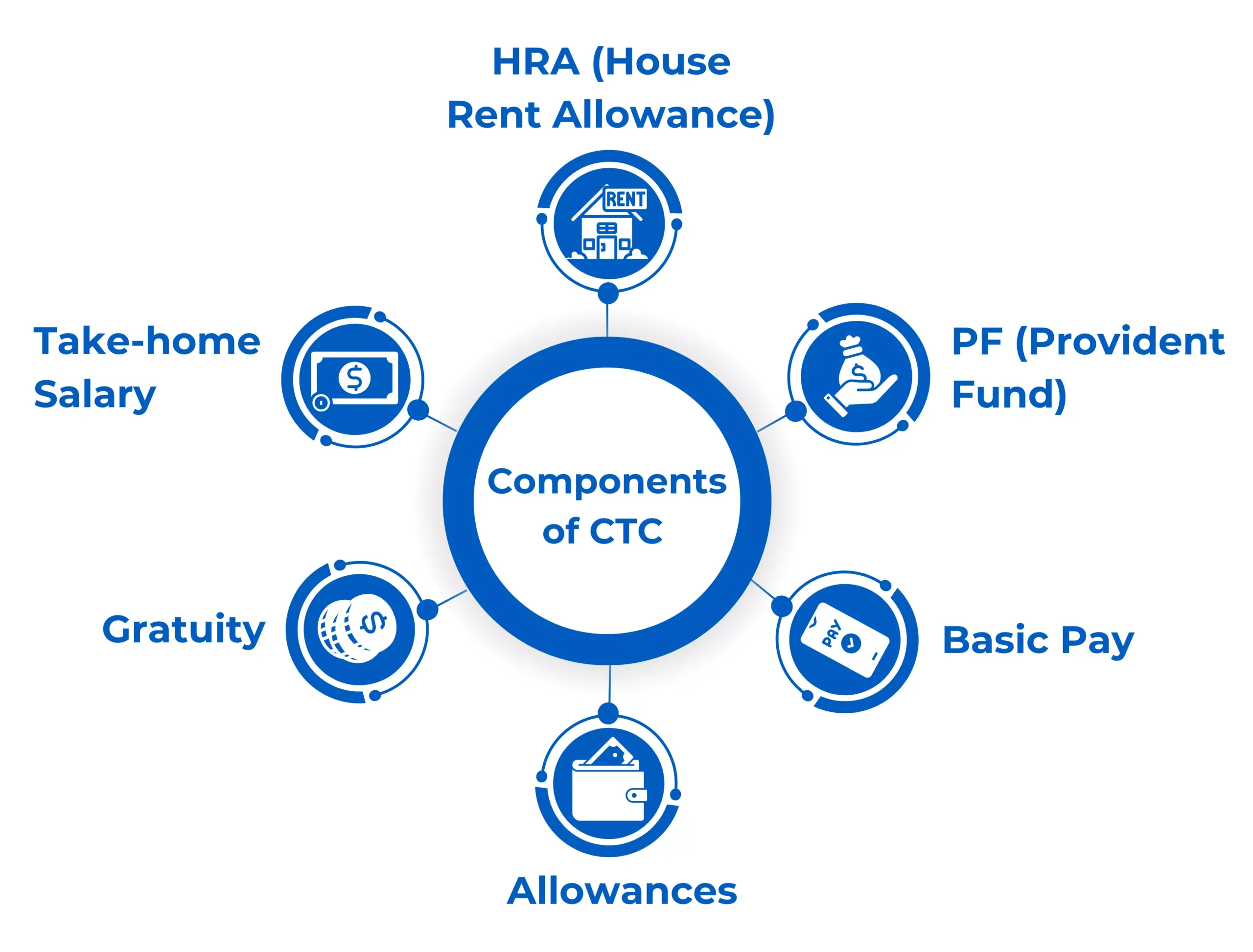

Understanding the CTC Components

CTC stands for the cost to the company, and it refers to the total amount company spends on the employee in exchange for their services. It includes all the allowances and other elements of the salary structure.

The provident fund, House Rent Allowance (HRA), basic salary and allowances are the primary components of the total cost to the company. Let’s understand a few terms first, to grasp the impact that the new wage code is likely to make.

House Rent Allowance (HRA)

House Rent Allowance is the sum company pays to the employee for their accommodation. One part of the HRA is taxable, and the other part is non-taxable income.

Provident Fund (PF)

The provident fund is a statutory investment that both employee and employer have to make. It’s a contribution towards the retirement benefits of the employee.

Also Read: How to claim PF Online? Step by Step Guide

Basic Pay

Basic salary or basic pay is the fixed component of the salary structure of the employees. Other elements in the salary structure are calculated on the basis of the amount of the basic salary. Presently the basic salary has to be at least 40% of the CTC.

Gross pay

This is the amount derived after adding all the allowances to the basic salary before the deductions.

Allowances

Allowances are various cash benefits that are added to your salary by the company for being part of the company. The type and the amount of allowance provided to the employee differ as per the working experience and the designation of the employees. The allowances form a significant portion of the overall cost to company.

Gratuity

Gratuity is the amount the company pays to employees for staying with the organization for a minimum of five years. This is given when an employee leaves the company.

Take-home Salary

The take-home salary is also known as the net salary or in-hand salary. It is the amount paid to employees after all the deductions such as TDS, PF, professional tax and more.

What will be the Impact of the New Wage Code on the Payroll?

Some changes in the primary components of the payroll will impact the salary structure and payroll, as described below.

Change in the Basic Salary

As a result of a new definition of wages in the New Wage Code, the basic salary cannot be less than 50% of your CTC. Currently, the basic salary has to be at least 40% of CTC and ranges from 30-40% of the gross salary.

That means all the payroll calculations that depend on the basic salary amount will also change. For employees with basic salaries lower than 50% of CTC, the salary structure has to be revised to stay compliant with the new regulations.

Changes in PF Contribution

Currently, the provident fund contribution has to be 12% of the basic salary. Looking at the new wage code changes, the PF contribution is also expected to increase. We are expecting a significant rise in the provident fund contribution after the implementation of the new wage code.

Changes for Gratuity

As mentioned above, gratuity is the amount paid to an employee for being part of the company for at least 5 years. Gratuity is a crucial component of gross pay. Under the new wage code employees that have worked for the company for 1 year are now entitled to receive gratuity now.

Also Read: What is Gratuity? How to Calculate Gratuity from your salary?

Changes in Allowances

As the new wage code increases the percentage of the basic salary in CTC, this decreases the contribution of the allowances. For example, if the basic pay in the salary structure of the employee increased from 40–50%, that means the allowances have to be decreased from 60% to 50%.

That will result in a major restructuring of all the allowances in the salary by the company. Now the allowance will shrink and must be adjusted by whatever per cent is left after the basic salary.

What Does it Mean for The Take-Home Salary?

The take-home salary of the employee is important to them, as that is the amount they get to spend if we consider the day-to-day expenses. This amount is the budget for the monthly financial planning of the employee, and the reduction here will also mean they have to make minor adjustments in their monthly expenses. Still, it will be more beneficial over the long run.

The changes in the wages are likely to reflect the greater amount to be deducted for the PF. Investment in the social security elements increase is an attempt toward a more secure future. So the increase is deductible PF amount resulting in the reduction of your take-home salary.

As per the new wage code act to be implemented in the near future the basic salary has to be at least 50% of the CTC. As your basic salary is a taxable income, the taxes are expected to increase. As organizations have to make changes to keep up with compliance with the new wage code. So under new labour codes, basic salary and taxes are expected to go up for employees with medium and low salary brackets.

As a result of an increase in PF and taxes under the new wage code, employees should be left with less take-home salary. The increase in the deductions is less likely to go up if your salary lies in the lower bracket.

Conclusion

The new wage code is an attempt toward securing the future of the employees in the long run by increasing contributions towards safety and retirement benefits. Where in the immediate impact is likely to be a reduction in the take-home salary.