What is a Payroll System and How It Works?

A payroll system is software used for automating payroll processing. It provides various features such as time-tracking, tax calculations, etc. As a result, companies can enjoy accurate and compliant payroll, reducing overall costs. This system gathers working hours, calculates salary by removing deductions, and distributes it, while also generating compliance reports.

Payroll System Guide

Businesses use payroll systems to process their employees’ payroll accurately. The payroll system enables HR and payroll departments to collect employee attendance information, calculate their wages precisely, deduct statutory taxes and other deductions, and disburse these wages to the staff members.

A payroll system is essential for businesses of all sizes as salary is one of the primary motives for employees to work in an organization. Since the system automates the process of salary calculation, statutory deduction, and disbursal, it becomes extremely easy for the HR teams to undertake payroll processing, while ensuring exact payments, on time, every salary cycle.

What is a Payroll Management System?

A payroll management system is a software that automates the entire process of payroll management, from attendance data collection to salary calculations, to the distribution of wages. This system streamlines the process of payroll management ensuring accuracy and on-time payments, every salary cycle. It also helps automate compliance handling as the system stays up to date with the changing statutory rules and regulations.

Importance of Payroll System

Being one of the major motivating factors for employees to work in an organization, payroll management is a critical part of the employee management process. With the help of a robust payroll system, you can compensate your employees accurately, and on time, every salary cycle.

Since the payroll system takes in employee attendance as the input and calculates their payroll automatically, there are zero chances of manual errors, resulting in increased efficiency, while also reducing the costs associated with payroll management.

The importance of the payroll system can be categorized into primarily 3 types:

1. Manual Error Avoidance

Having a dedicated payroll system helps you avoid manual errors which can be a major hassle with manual payroll processing. It also takes care of compliance automatically, as any errors in it could result in hefty fines.

2. Cost-effective Payroll Management

By processing employee payroll with the help of a payroll system, companies can save their time and effort by avoiding manual calculations. It is also budget-friendly for companies as they need not hire dedicated payroll managers.

3. Convenient Accessibility

Payroll systems are relevant for organizations as modern systems are hosted on the cloud, which provides you with 24/7 remote access. It helps your HR and payroll team access and manage your employee and payroll data from anywhere, using any internet-enabled device, making it highly accessible.

Difference Between Manual & Automated Payroll Systems

Feature | Manual Payroll System | Automated Payroll System |

Efforts | Requires more effort since data collection and salary calculations are undertaken manually. | Since the entire payroll process is managed by software, it requires less effort. |

Bottlenecks | It has many bottlenecks as it requires coordination, collaboration, and approvals from different departments. | Since it is fully automated, there are fewer bottlenecks, which can be removed through hardware and software optimizations. |

Consistency | Since it is dependent on human activity, it can be highly inconsistent. | It remains consistent as the processes are automated. |

Accuracy | With manual processing, there is always a possibility of human error. | It ensures maximum accuracy due to automated calculations and minimal human intervention. |

Security | It does not have any in-built security measures due to manual paperwork. | It provides enhanced security with data encryption and user access control. |

Cost | It is relatively cheaper; however, manual errors and reduced efficiency result in increased costs. | While the initial costs are higher for automated systems, they become the cheaper option in the long run due to efficient processing. |

Reporting | Reporting requires more time and effort, as the data is maintained on paper mostly. | Since data is available in real time, reporting becomes extremely easy. |

Scalability | Scaling manual systems requires hiring new staff and training them, which is time-consuming. | Since automated systems have in-built scaling mechanisms, they are much easier to scale. |

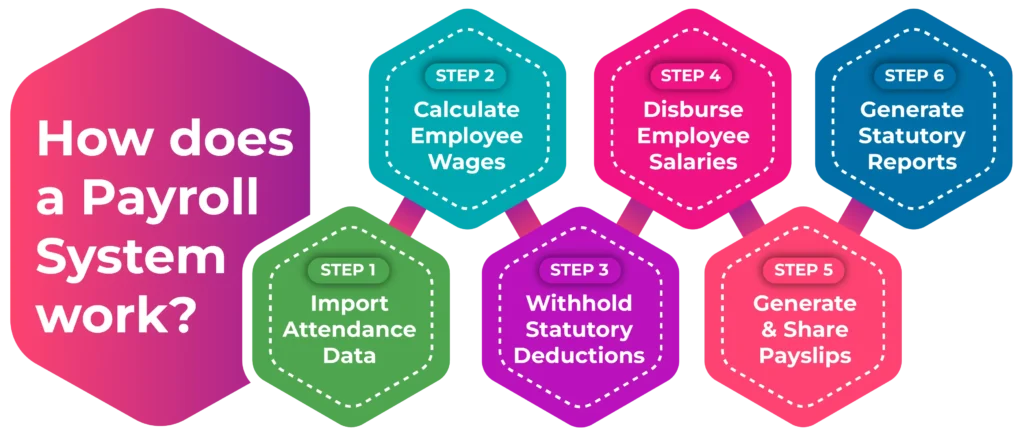

How Does a Payroll System Work?

The payroll system streamlines the process of calculating and paying employees while handling their compliance with statutory regulations. It calculates gross pay, deducts taxes and other withholdings, and then distributes the net pay to employees via direct deposit or cheques.

Here’s a more detailed look at how a payroll system works:

1. Data Input

The payroll process begins with HR entering an employee’s data, including their name, bank account information, and other details into the system.

2. Time Tracking

The system tracks an employee’s working hours for a salary cycle, using either manual methods or with the help of time-tracking software.

3. Gross Pay Calculation

Based on an employee’s information and hours worked, the system calculates their gross pay, which is the total earnings before any statutory and voluntary deductions.

4. Deduction Calculation

In the next step, the system calculates and deducts various amounts, including different taxes such as income tax, professional tax, etc. It also includes deductions such as health insurance premiums, gratuity, and other voluntary deductions.

5. Net Pay Calculation

Next, the system calculates the net pay by removing the deductions from the gross pay of the employees.

6. Payment Processing

Later, the payroll system generates pay slips and initiates direct deposit payments to the employee.

7. Reporting

Once the payments are undertaken, the system creates reports for tax filing, payroll expenses, and record-keeping.

Key Features of a Payroll System

Following are some of the key features of a payroll system:

Streamlined Payroll Processing

The payroll system automates the entire payroll management process, from wage calculation, and tax management, to salary disbursals and reporting, resulting in accurate payments. It helps capture the attendance information from the attendance management system, calculates the exact gross salary, deducts income tax and other withholdings, disburses the net pay to employees, and generates pay slips and other statutory reports.

Automated Compliance

The system also automates compliance handling by deducting the taxes automatically from the gross salaries of employees. Additionally, it stays updated with the latest tax changes, ensuring that the payroll calculations adhere to any changes in the regulations. It helps deduct TDS and other taxes from employee salaries automatically, resulting in a compliant payroll, every salary cycle.

Employee Self-Service Portal

Modern payroll systems also provide their employees easy access to their pay slips and related information, through their ESS portals. This portal enables them to view their payroll information such as their salary structure, additional benefits, etc. It helps to improve overall transparency, resulting in loyal employees.

Customized Reporting

Similarly, payroll systems also generate various reports, including payroll summaries, tax forms, and custom reports, for insightful analysis and decision-making. While some of these reports are mandated by the government for submission to the income tax department, others are generated for analysis within the organization. Hence, it is one of the most essential features of any payroll system.

Data Security

Data security is another major feature of the payroll system as it is required to protect sensitive payroll data. Hence, it comes with various robust security measures, such as enterprise-grade data encryption, secure user access controls, and regular backups of the data with a well-defined contingency plan.

Seamless Integration

The system can also be integrated with other HR and accounting software to streamline workflows and reduce redundancy. It improves the efficiency of the HR teams as they can seamlessly transfer data between systems, which also results in reduced HR workload.

Benefits of Using a Payroll System

There are numerous benefits of implementing a robust payroll system, such as:

1. Increased Efficiency

Payroll systems automate many manual tasks, reducing the risk of human error in calculations, deductions, and data entries. Hence, the process gets undertaken efficiently, resulting in on-time payments every salary cycle, which encourages the staff to trust their company to compensate them timely for their time and effort.

2. Quicker Processing

Similarly, payroll systems can process payroll much faster than manual methods, ensuring timely payments. Since the system is automated, the payroll team simply needs to ensure that accurate attendance information and other monthly inputs are provided to the system for calculating employee wages precisely and disbursing them on time.

3. Accurate Records

Additionally, payroll systems provide a centralized and organized way of record-keeping, making it easier to find and access payroll information for the HR team. Since the records are stored in secure servers, they cannot be tampered with, resulting in enhanced data security, ensuring the safekeeping of payroll records for the future.

4. Automated Compliance

Payroll systems also help businesses stay compliant with labour laws and statutory regulations. It enables them to deduct income tax accurately and file the details with the income tax department. Since the system takes care of tax deductions automatically, it ensures that the calculations remain accurate and up to date with the ever-changing tax regulations.

5. Easier Reporting

Payroll systems provide real-time reporting and analytics, allowing businesses to monitor payroll trends and make informed decisions. It helps them manage their expenses according to changing business environments and ensure they remain within the defined budget. Having these insights helps them make positive changes to ensure they stay competitive in the market.

6. Simplified Access

Employees can access their payslips, tax forms, and other payroll-related information through the employee self-service portal within the payroll system. It helps them understand their payroll structure and the taxes they are paying to the government. Additionally, it informs them about the various additional benefits in their salaries, providing increased transparency.

Types of Payroll Systems

Understanding the diverse needs of organizations, various types of payroll systems have been developed over time. These systems are tailored towards varying requirements of diverse business sectors, providing them with easy payroll management.

There are several types of payroll systems based on their implementation:

1. Cloud-based

This is the ‘set it and forget it’ type of payroll system where organizations deploy the software on the cloud, from a third-party vendor who is solely responsible for online updates, user management, and the overall maintenance of the system. The users get flexibility in accessing the software from anywhere by using internet-enabled devices. Moreover, cloud-based payroll systems provide enhanced security features that enable robust security of employees’ sensitive information and reduce data theft concerns.

2. On-premise

On-premise payroll systems are one of the more common software solutions that facilitate organizations to deploy the software within their company’s in-house computing infrastructure. The on-premise payroll software, developed internally, is usually deployed on company servers, requiring the organization to manage both the software and the hardware aspect of the system. This self-reliant approach results in the company bearing the associated payroll processing costs. These systems are mostly installed by companies who are sceptical about third-party vendors regarding the security of their data.

3. Integrated HR and HRMS

An integrated HR software and HRMS payroll application combines the functionalities of payroll processing and HR processes within a unified platform. This integrated approach enables businesses to manage employee data, added benefits, attendance, and payroll processes seamlessly and accurately. In the diverse business world, the integration of software applications is essential to keep up with the fast-evolving market requirements of managing the workforce.

4. Global Software

Global payroll systems handle international currencies, tax laws and regulations. When a company has a global presence, the difficulty in calculating tax provisions varies according to the different governmental and labour regulations. In such cases, global software for processing payroll enables you to convert currencies and comply with the laws and regulations while evaluating payroll and managing the complexities in calculations.

5. Open-source

Open source software is publicly available software that can be accessed by everyone in general and can also be customized by organizations as per their needs, as the source code is publicly accessible. It is highly flexible, while also being free mostly. It enables its users to view, modify, add, and tailor the application as per their preferences. Although it has a vivid reach, its deployment and maintenance require technical expertise, which hinders organizations from using it.

Choosing the Right Payroll System for Your Business

Selecting the right payroll processing application is crucial for any business as it will not only improve the organization’s efficiency but also help in managing the workforce by processing their payroll accurately on time.

Hence, let us check out the factors to consider while selecting the best payroll system in India:

Business Requirements

The most important factor to consider before choosing a payroll system for your business is to evaluate the requirements of your business and workforce, and if it suits your company’s size and needs. Assess your business requirements such as office locations, diverse employee types, and varying pay structures by keeping the size of your business in consideration.

Budget Considerations

Business finance management is pivotal for the sustainability of any business. So, it is crucial to plan the budget accordingly, to avoid wastage of resources and finances. You should evaluate the total cost of ownership, including initial setup costs, ongoing fees, and potential hidden costs of payroll management to get a suitable payroll system in the budget.

Compliance with Regulations

You should also consider whether the payroll system complies with state and central laws associated with companies to avoid legal lawsuits. Additionally, the system should be able to adapt to changes in laws and regulations to match the fast-evolving organizational needs.

User-friendly Interface

You need to choose an online payroll system that has a user-friendly interface, to ensure increased accessibility to the end-users. Not all employees in an organization would be tech-savvy; so, it is essential to have a payroll system that has a user-friendly interface for seamless usage and to reduce the learning curve for HR and payroll teams.

Support & Service

Before setting up a payroll solution, you should also ensure that the vendor provides you with adequate support during and after its implementation to avoid discrepancies and possible issues in the future. A robust support and implementation team is a vital necessity for a payroll processing system as any errors can diminish the efficiency and accuracy of the entire payroll system.

Integration Capabilities

To ensure seamless integration of HR processes, you should check whether the chosen payroll system integrates with other business systems, like time and attendance tracking or benefits administration, etc. Such integration capabilities help in seamless data transfer between platforms, enabling an efficient experience for HR.

Which Industries Use Payroll Systems?

While payroll systems are required by all industries, some of the common ones that use these systems are:

Information Technology

Since the information technology sector consists of technically sound staff members, implementing a payroll system is a no-brainer for companies in this industry. Additionally, most of the staff members from the IT industry work remotely, which results in companies opting for a dedicated ESS portal to ensure transparency, along with a payroll system.

Hospitality

The hospitality sector consists of multiple challenges when it comes to employee payroll such as hourly wages, tips calculation, unpredictable shift management, along with high turnover. Hence, payroll systems are critical for this industry as the variables can be fed into the system to streamline employee payroll despite the numerous challenges listed above.

Manufacturing

Manufacturing is another major industry where HRs face numerous challenges related to employee payroll such as diverse pay scales, overtime and bonus calculations, expense management, and round-the-clock shift management. To ensure that the staff members receive accurate payment, they need to integrate their attendance data with payroll information using a payroll system.

Construction

The construction sector has its fair share of unique payroll challenges such as various pay grades, project-based wages, additional laws related to blue-collar workers, etc. With the help of a robust payroll system, HRs can automate their salary calculations as the system takes care of statutory compliances, resulting in efficient and accurate payments.

Retail

The retail sector employs staff in shifts according to the changing requirements of the customers. Hence, their HR teams need to deal with fluctuating schedules, part-time shifts, as well as seasonal business requirements. As a result, payroll systems are a necessity in this sector to automate employee payroll and relieve the HR of stress from manual calculations.

Healthcare

Healthcare is another sector where shift management is critical due to the nature of the business. Hence, payroll processing becomes difficult in this sector due to erratic shifts, overtime, different pay grades and employee types, as well as additional statutory guidelines related to the health industry. Hence, payroll systems are essential for businesses in the healthcare sector.

Education

The education sector also utilizes the features of payroll systems as schools and colleges consist of employees of various categories. Since they employ contractual staff, such as substitute teachers, clerks, administrative personnel, peons, etc. they require the services of a robust payroll system to ensure accurate salary disbursals every pay cycle.