Payroll Software

Advanced smHRt Payroll with Automated Compliance Handling

Quick, Accurate and Error-free processing fulfilling Advanced

Payroll Requirements and Statutory Compliance.

Streamline your Payroll Operations with Payroll Management Software

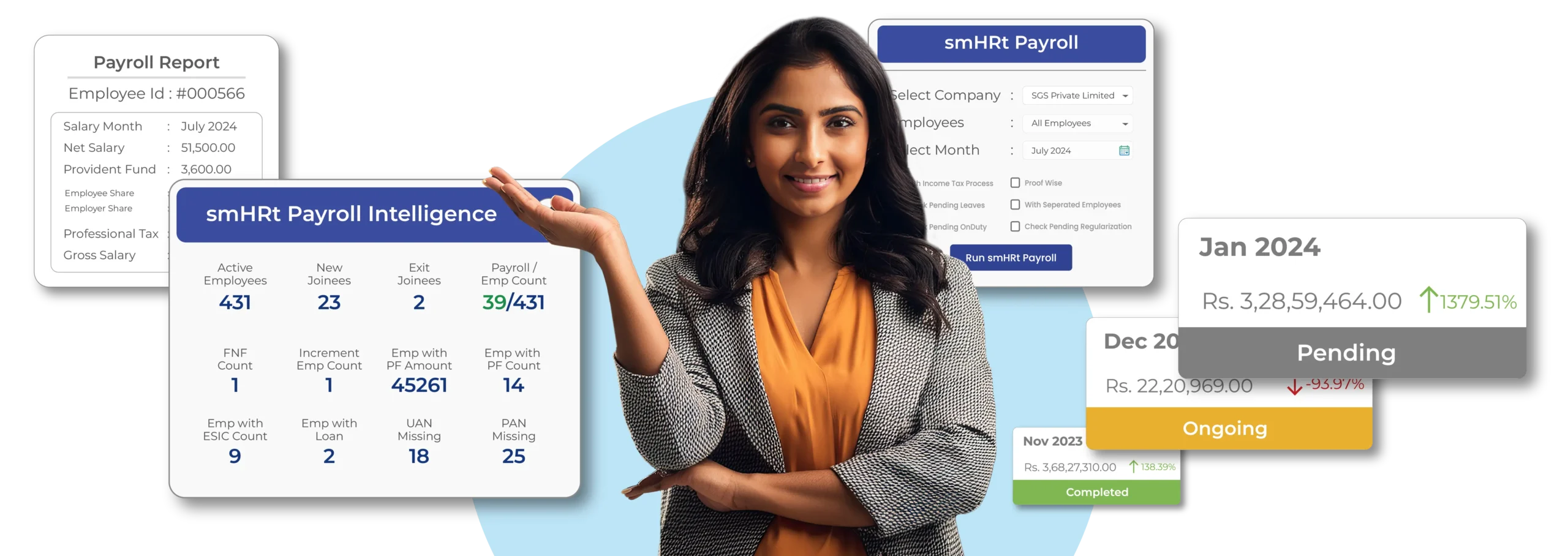

Next-Gen smHRt Payroll

Employ the Intelligence of Machine Learning to process your Employee Payroll accurately minimizing the processing time to a few minutes.

Comprehensive Payroll Overview

Quick Overview of Payroll Information for ensuring accurate payroll processing and improving visibility within ESS Portal.

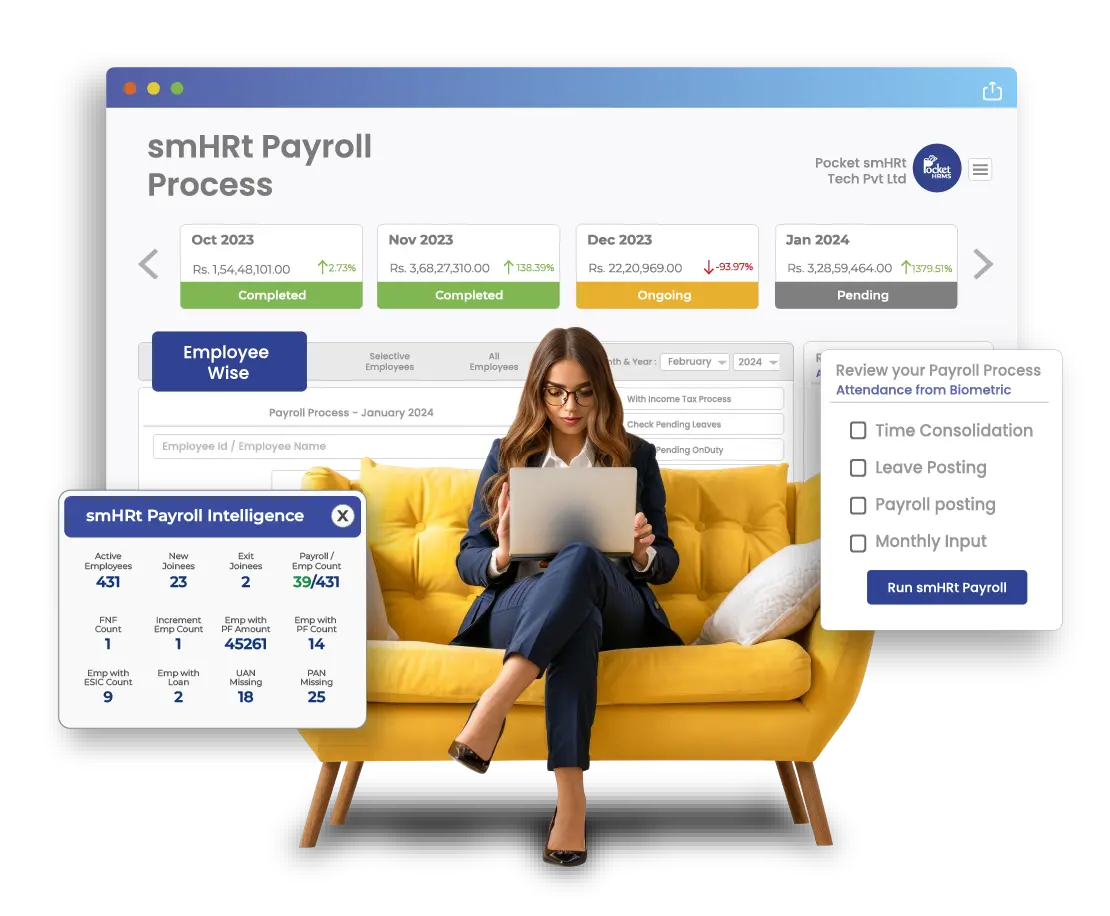

Payroll Processing Pre-checks

Option to select Time Consolidation, Leave Posting, Payroll Posting, Monthly Input, Bulk Supplementary and Bulk LOP Credit.

Multi-Company Payroll

Manage payroll details of multiple ventures in your business using the same access for HRMS Software.

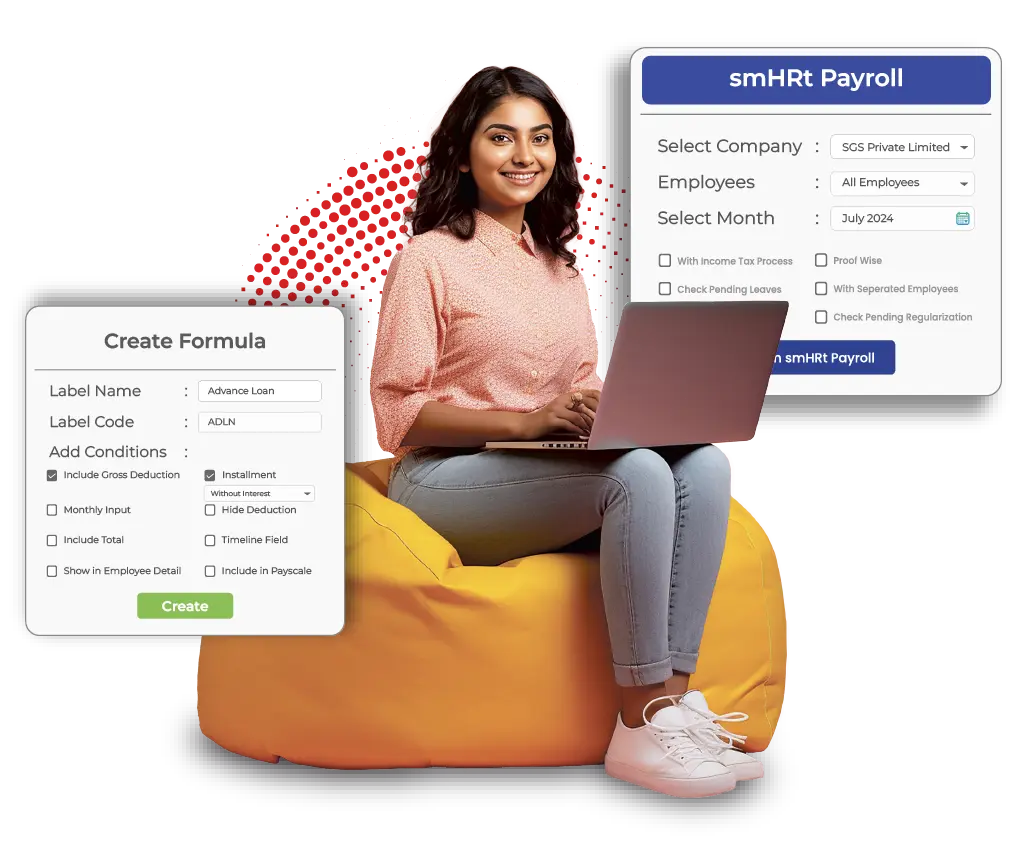

Multi-Structure Payroll

Easily create multiple employee categories for setting different payroll rules, by integrating with Leave Management System.

Conditional Formula Builder

Change salary heads with custom formulae, right from your employee management system, without depending on the developer.

Automated Calculations

Streamline payroll calculations such as arrears, provident fund, professional tax, IT, ESI, etc.

F&F Calculations

Smooth exit with automated gratuity calculations, leave encashment and asset recovery.

Background Processing

Multitask efficiently by batch processing payroll in the background to improve productivity.

Experience this Amazing Cloud-based Payroll Software for Yourself

Advanced Payroll Solution Functions for Effortless Payroll Processing

Payroll Calculations

Custom options for payroll calculations using complex formulae

Compliance Handling

Automates compliances by deducting taxes and providing benefits

Salary Disbursal

Distributes employee salaries automatically once the processing is complete.

Attendance Tracking

Tracks employee attendance for accurate payroll according to their ‘present’ days

Analytics & Reporting

Provides in-depth analytics and custom reporting options

Employee Self-Service

Employee self-service options like a web portal for 24/7 remote access to employees

Top-Rated HR Software in India

Pocket HRMS is a leading HRMS software solution provider, recognized by top-notch review platforms like ‘G2‘ and ‘Software Suggest‘ for its revolutionary features.

Download Product Brochure

Get detailed information on the numerous next-gen features of one of the most feature-rich Payroll & HRMS Software in India

New-age Online Payroll Software Features, Easy-to-use Cloud Solution

Payroll Processing

Avoid manual errors with automated payroll processing, enhancing accuracy and efficiency.

Compliance Handling

Automate compliance handling with automated cross-verification against local and national laws.

Analytics & Reporting

Quickly generate statutory reports with in-depth analytics to stay on top of salary budgets.

Time Tracking

Tracking employees’ login hours accurately, enabling accurate payroll calculations.

Secure Database

Secure confidential employee data with enterprise-grade encryption and secure access control.

Software Integration

Interface with other commonly-used HR systems for streamlined flow of data between systems.

#1 Choice of Industry Experts

Resources for HR and People leaders

What is Payroll Management | Pocket HRMS

Payroll management is the process of managing employees’ payroll, which includes managing salaries and the breakups associated with them.

What is a Payroll Report: Functions and Usage

Payroll Reports are essential for any organization since it serves in improving the overall organizational efficiency as well as helping maintain compliance.

Payroll Processing: Meaning, Definition, & Steps

Payroll processing is an integral part of employee management as salary is one of the key motivating factors for employees to work for their organization.

FAQs

What is Payroll Software?

Payroll software is a system that automates the entire process of payroll. It is an all-in-one solution to manage payroll and ensure that it complies with the tax and financial regulations. It simplifies payroll processing by automating employee taxes calculations, their monthly inputs for payroll processing, leave calculations and other related tasks.

How much does Pocket HRMS Cost?

The Standard Plan of Pocket HRMS costs ₹2,999 per month for up to 50 employees. If you employ more than 50 employees, then you can pay an additional ₹60 per employee per month to enjoy the numerous features of the Standard Plan.

Similarly, the rate for the Professional Plan of Pocket HRMS is ₹4,499 per month for up to 50 employees. If you employ more than 50 employees, then you can pay an additional ₹90 per employee per month to enjoy the extra features of this Plan along with the Standard Plan features.

The most feature-rich plan of Pocket HRMS is the Premium Plan which has all the features provided in the Professional Plan along with additional exceptional features which make Pocket HRMS revolutionary software for your organization.

How is Pocket HRMS Payroll different from the other Payroll Software?

The main difference between Pocket HRMS and any other payroll software in India is the ‘smHRt Payroll®’ feature, which utilizes Machine Learning to learn your payroll patterns over time and highlight any errors in your payroll data. Using the smHRt Payroll® system, you can process your employee payroll quickly with simplified steps, as the system takes care of capturing errors.

Pocket HRMS’ payroll module also enables you to upload the attendance data from your employee records using your biometric attendance hardware. It also comes with simplified options to view each month’s payroll data as well as state-wise statutory compliance details for easier payroll processing. The system also automates the process of payslips and custom reports generation, improving the overall efficiency of the payroll processing teams.

Can Pocket HRMS Payroll software handle multiple pay schedules?

Absolutely! Pocket HRMS payroll is customizable to your exact payroll requirements. By configuring it to handle multiple pay schedules, you can process salaries and generate payslips whenever you require, ensuring complete flexibility. Additionally, processing your employee salaries through ‘smHRt Payroll’ ensures complete accuracy and enhanced efficiency.

Is the data secure with your payroll software?

Pocket HRMS is hosted on Microsoft Azure, which utilizes 256-bit enterprise-grade encryption standard to keep your payroll data safe and secure. Combined with robust uptime and architecture, Microsoft Azure has proven to be the best option to safeguard sensitive data like employee payroll information. So, yes, the data remains completely secure with our cloud payroll software.

Can Pocket HRMS payroll software integrate with other systems?

Yes, Pocket HRMS payroll software can be easily integrated with other systems as processing payroll is a complicated task and it must remain as streamlined as possible. According to the Times of India, streamlining payroll management ensures accurate and timely compensation to employees. Hence, we have developed it from the ground up keeping integration, scalability, and flexibility in mind.