10 Best Payroll Software in India 2025: Features & Pricing

Discover the ideal payroll software for your business from a curated list of the top 10 choices in India.

In the current era of automation and advancement in the technological realm, good payroll software is an essential key for productive output and quick processing. To match the pace of the rapidly changing market landscape, your organization must automate vital tasks such as payroll processing to stand out of the crowd and have an impactful presence among your competitors.

However, the biggest questions arise while choosing the right payroll software that would best suit your organization’s requirements, needs, budget, and convenience. In the further content, we will cover the major aspects to help you understand payroll software, parameters to consider while choosing the best payroll software, and the top 10 best payroll software in India.

What is Payroll Software?

Payroll software is a cloud-based system that automates an organization’s entire payroll and finance-related tasks like calculating earnings and deductions, generating payslips, maintaining compliance, simplifying tax filing, and more. It integrates with HRM software to track employee wages while tracking employee working hours and attendance.

According to a research report by Allied Market Research, the global HR payroll software market was valued at $23.55 Billion in size. It is projected to grow to $55.69 Billion by 2031, at a CAGR of 9.2%. Employees can use payroll software to review their payroll-related information, identify payment preferences, simplify tax filing, and understand compensations, deductions, etc. For employers, the software simplifies daily HR tasks, enhances accuracy, reduces manual errors, and increases payroll flows and overall efficiency in the payroll administration process.

14 Simple Steps on How to Process Your Payroll

Here are the simple steps of how to process your payroll correctly. The following process applies to employees from startup agencies to large enterprises.

Top 10 Best Payroll Software in India 2025

There are more than a hundred payroll software companies worldwide. But one question arises, which one can be the best for your business? We are collecting a list of the best payroll software for SMEs & large scale industries based on factors like unique features, cloud appearance, compatibility, price, integration, customer support, compliances, and reviews. Let us explore the prevailing 10 best payroll software in India:

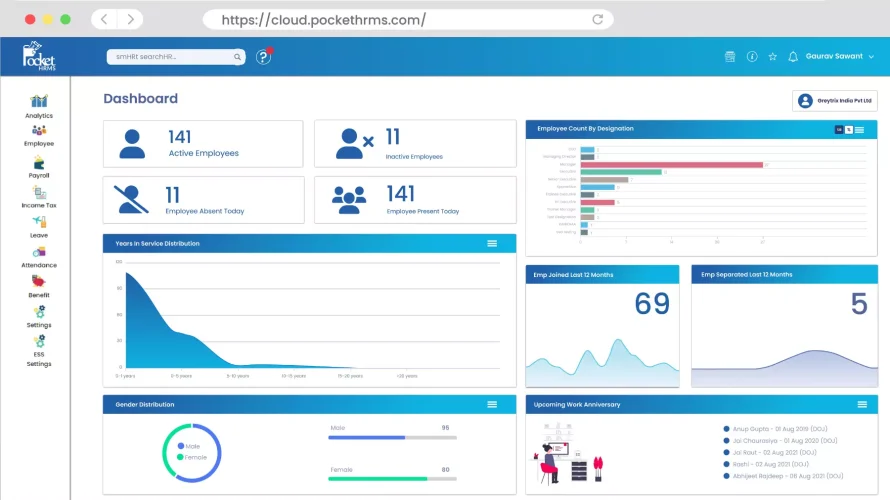

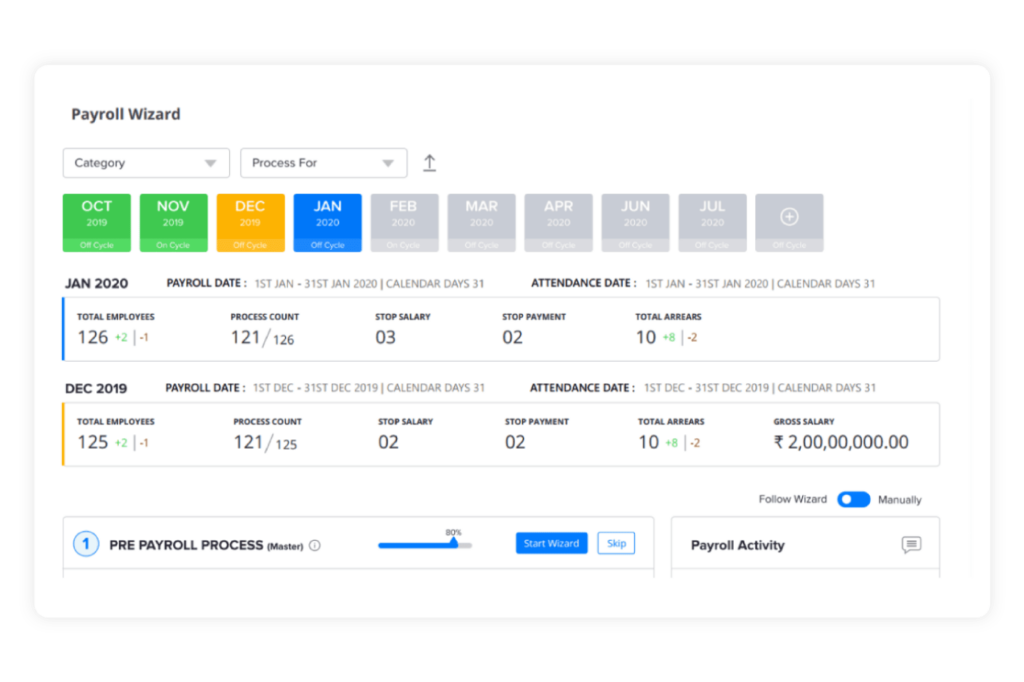

Pocket HRMS is a cloud-based HR management system and one of the top payroll software in Mumbai, which ensures streamlined payroll management with advanced features like automated calculations, error-free data, compliance handling, tax filing, compensation management, attendance tracking, and more.

Additionally, it is a highly scalable solution for businesses of all sizes, offering seamless approaches to human resource management. Its user-friendly smooth interface enhances efficiency and promotes transparency by providing a centralized platform. It also comes with an expert support team for managing HR-related activities. Some key features of Pocket HRMS include:

▸ Key Features:

- smHRt Payroll Management

- HRchatbot smHRty

- Accurate Time Tracking

- Performance Management System

- Proficient expense management

- Leave Management System

- Efficient Recruitment & Onboarding

- Mobile App + smHRty Chatbot

- Transparent Performance Management

- Oustanding Employee self-service (ESS)

- Systematic Expense management

- Sustainable project management

- Productive performance management

- Shift Management Software

- GenAI-enabled Recruitment System

- Employee Management System

- Employee Offboarding Software

▸ Ideal For

Ideal for small, medium-scale businesses and multi-national companies. It suits enterprises seeking a highly flexible payroll management system with advanced features and integrations.

Businesses of India

Businesses looking for integrations

Companies focused on compliance

Companies with a digital focus and more.

▸ Advantages of Using Pocket HRMS

- Provide simplified and quick onboarding for employees

- Efficient analytics and tools for generating workforce trends and performance

- High-end security of every employee’s data.

- Proficient self-service portals for updating information, checking payslips, and requesting leaves.

- Authentic KPI monitoring for efficient performance tracking and analytics.

▸ Disadvantages of using Pocket HRMS

No linking between the two companies for auto-transferring employees’ data safely.

No international business access

▸ Pricing

As a standard Option ₹2495/month for up to 50 employees then ₹40/per employee/per month.

As a professional option ₹3995/month for up to 50 employees then ₹80/per employee/per month.

For premium option organizations have to call for pricing.

▸ Google Rating

- 4.7 out of 5.

2. factoHR

FactoHR is an HR Payroll tool that helps businesses no matter their size. It makes payroll processing super easy with automated calculations and tax filing tailored to specific regions. You can keep track of attendance, handle leave requests, and plan shifts all in one place.

▸ Key Features:

▸ Ideal For

- Small and medium enterprises

- Large enterprises that require scalable HR systems

- Organizations that emphasize compliance and digital platforms

▸ Advantages of factoHR

- It offers smooth employee onboarding

- Helps you stay compliant with the law

- Offers accurate + timely payroll calculation

- Promising data security

- Easy integration with current systems and tools

▸ Disadvantages of factoHR

- The UI/UX might feel confusing to the new users.

▸ Pricing:

They’ve got a free trial (because who likes jumping to conclusions?). Let their team be your shopper, picking the perfect plan without sticker shock.

▸ Google Rating

4.4/5 on Google

- Automatic payroll processing

- Biometric integration attendance tracking

- Leave management system

- Employee self-service mobile app

- Performance tracking and reports

- Travel and expense management

- Document and asset management

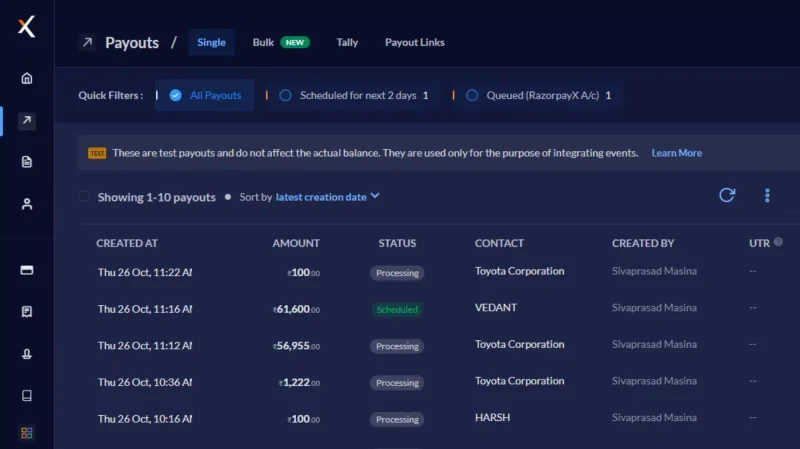

3. Razorpay

Razorpay is an outstanding HR and Payroll software that robustes your business by providing a payment gateway. Its user-friendly interface allows users to streamline entire HR processes conveniently.

Razorpay aims to simplify the payroll and the entire compliance process for the employees. It also provides an in-depth superior employee experience report for your business operation and workforce improvement.

▸ Key Features:

- Proficient Document Management system

- Efficient Employee Self-Service Management

- Exit Management & Separation Management

- Auto Time & Attendance Management

- Outstanding Workforce Management

- Efficient Leave Management

- Smart collaboration with NEFT, UPI IDs, etc

- Efficient Payment gateway availability.

- Seamless Insurance Tracking, Auto ITR filing

- Proficiency in Health & Wellness for employees

▸ Ideal For

Start-ups and growing businesses

Small to medium-sized businesses

Tech-savvy businesses

Organizations with simple payroll needs

▸ Advantages of Razorpay

Accessibility of a wide range of payment options

Seamless user experience

Safe and secure transactions with high-end data protection

Quick payment settlement option for Small and medium-sized businesses (SMEs)

▸ Disadvantages of Razorpay

Customer support is not satisfying

Limited international presence

Numerous search issues, connected to API

▸ Pricing:

- For Prime ₹2499 for the first 20 employees in case of annual pricing. And ₹2999 for the first 100 employees in case of monthly pricing.

- For Elite ₹5499 for the first 20 employees and ₹ 5999 for the first 100 employees.

- Pricing for enterprise users is available on demand.

- Note: additional 18% GST applicable.

▸ Google Rating

- n/a

4. GreytHR

GreytHR is a popular cloud-based HR payroll software that ensures streamlined HR processes and accurate employee payroll handling. It provides users with a fast and hassle-free experience in on-time disbursement of salaries, Auto tax filing settlement, Automated reimbursements, loans and advances, etc. Hence It is well-known for improving the overall productivity of your business and workforce.

▸ Key Features:

- Secure Employee Data Base

- Smooth App Interface

- Efficient employee management

- Auto salary adjustment and formula-defined Salary Calculation

- Smooth and quick onboarding process

- Proficient Biometric Attendance Management

- Proficient Biometric Attendance Management

- Errorless PF/ESIS Calculation, transparent Ad Hoc and MIS Reports.

- Self-onboarding & transparent Salary Information & History

- Outstanding Geo tracking and Multi-Location tracking facilities

▸ Ideal For

Diverse Industry verticals

Small to medium-sized businesses

▸ Advantages of GrytHR

All company policy in fingertips docs instead of searching for it elsewhere

UI was very simple and user-friendly

Auto attendance and performance tracker.

Smooth Mobile interface, equipped with all features.

Enabled Remote attendance marking and GPS tracking

▸ Disadvantages of GrytHR

It is not an errorless application. Users face bugs and errors and need improvements in resolving bugs.

UI is straight and clean but going with the trend.

The free plan contains a few features

Global communication is not possible

▸ Pricing

In the starter phase, the company doesn’t take any amount and users get limited facilities

In Essential, ₹3495/ month is pricing for every 20 employees

In the Growth phase ₹5495/month is the pricing for every 50 employees

In the Enterprise phase, ₹7495/month is the pricing for 50 employees

▸ Google Rating

n/a

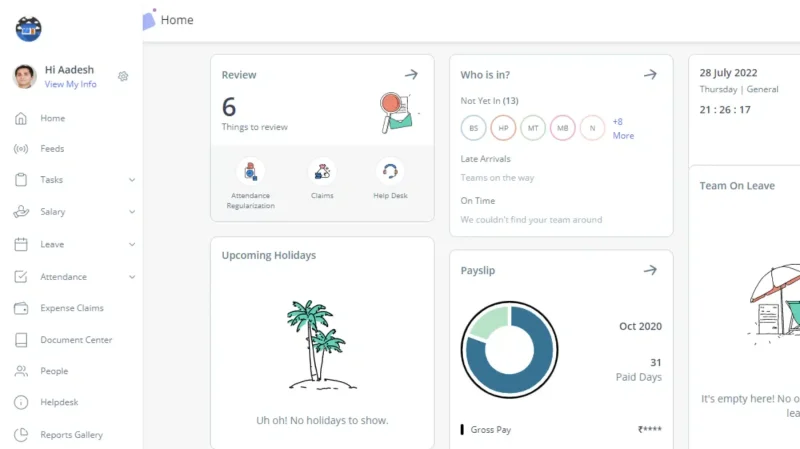

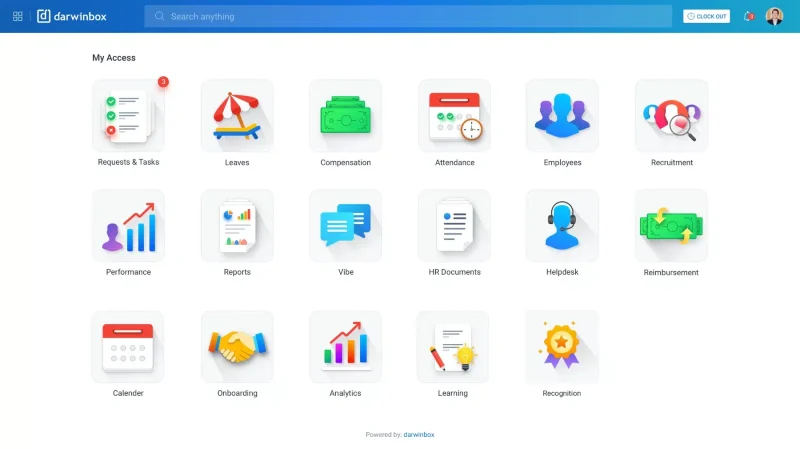

5. DarwinBox

Darwinbox is a cloud-based HRMS platform that provides reliable payroll software solutions for businesses. It allows users to input delivery details, process payroll, and extract reports within seconds. It has a user-friendly UI providing high-end features like smooth salary disbursal, auto pay slip generation, streamlined tax filing, multiple pay schedules, and many more.

Additionally, it is mobile responsive. Users can maintain multiple companies, departments, and payrolls using a single software solution.

▸ Key Features:

- Smart desktop experience

- Complete assets management

- Hassle-free email integration

- Powerfully secured data management

- User-friendly integration with other system

- Customizable payslip design

- Efficient Leave management

- Outstanding Expense Management

- Proficient Reimbursement Management

- Streamlined employee shift management

▸ Ideal For

- Darwinbox is often considered suitable for medium to large enterprises in India.

▸ Advantages of Darwinbox

Userfriendly navigation

Simplified and intuitive interface, equipped with all features

Availability of Auto payroll disbursal facility

The presence of an outstanding desktop user interface

▸ Disadvantages of Darwinbox

Need to module customization, it runs only in pre-defined module terms and services.

Need some improvement in the mobile user interface.

The payroll module become old and needs some work on it

▸ Pricing:

Pricing for enterprise users is available on demand.

▸ Google Rating

3.7 out of 5

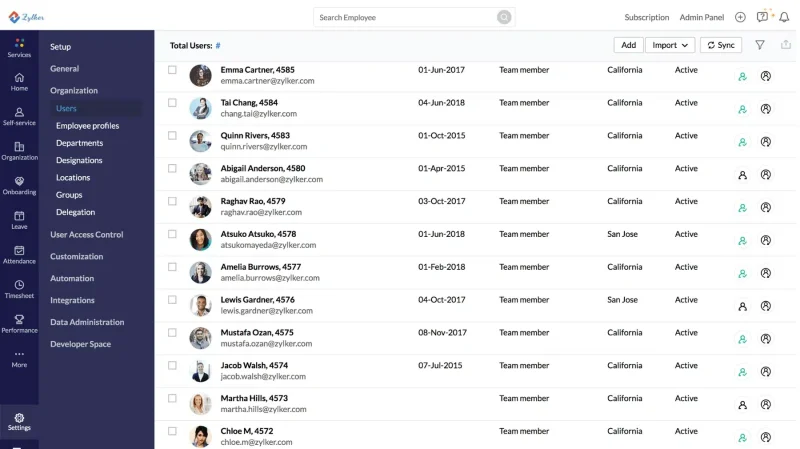

6. Zoho

Zoho is one of the payroll accounting software for small businesses in HRMS industries. It provides an end-to-end automated payroll solution that ensures timely salary disbursal, manages payroll, smooth employee onboarding, employee self-service, auto tax filing and other statutory compliance, and more.

With more than 25 years of experience, Zoho provides an affordable payroll structure with a starting price of ₹ 50 per employee per month. Numerous small and mid-range companies can subscribe to Zoho and enjoy the benefits of reliable payroll software.

▸ Key Features:

- Efficient attendance management system

- Affordable for users

- Time off management system

- Effective Timesheets management

- Employee self-service features

- Proficient Payroll management system

- Auto Tax management system and TDS calculation

- Streamlined Performance management system

- Hassle-free Compliance management system

- Ensuring Better employee data security

▸ Ideal For

- Medium and large-sized organizations.

Small to medium-sized businesses.

▸ Advantages of Zoho payroll

Affordable pricing suitable for small, medium and large industries

Flexible and automatic tax calculation and documentation

Simple and eye-catchy user interface, easy to navigate

▸ Disadvantages of Zoho payroll

Less customizable compared to other Zoho products

An error appeared in the bank and Zoho book integration. Users can not integrate the same bank account in a different Zoho platform with a different organizational ID.

▸ Pricing

In the basic phase, Zoho payroll is free up to 10 employees

In the standard phase, Zoho payroll takes ₹40 per Employee up to 25 employees per Month billed annually.

In the premium phase, Zoho payroll takes ₹60 per Employee up to 50 employees per Month billed annually.

Note: Price exclusive of GST

▸ Google Rating

- 4.5 out of 5.

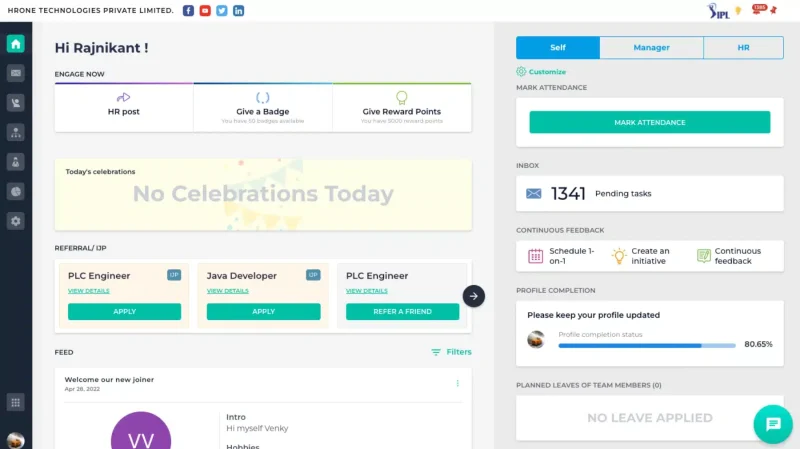

7. HROne

HRone is one of the best HCM and payroll software. Its best payroll system provider is a high-end, user-friendly solution for employees. It ensures an automation method for helping organizations manage their HR and Payroll functions. Users can enjoy a streamlined payroll process along with tax filing and other compliances. HRone also makes an ‘Inbox-for-HR tool that makes employee management as intuitive as an email client.

▸ Key Features:

- In-depth Performance Analysis

- Inclusive core HR management capabilities

- Transparent Payroll Management

- Enhanced Performance Management

- High-end Attendance Management

- Dedicated Expense Management

- Streamlined Recruitment Management

- Clarified Asset Management

▸ Ideal For

- Small to medium-sized businesses.

▸ Advantages of HROne

Presence of smooth attendance facilities

Robust security features

Effective user-friendly HRMS payment tools

Simple and eye-catchy user interface

▸ Disadvantages of HROne

The app integration needs improvements

Mobile app works slowly, it consumes a lot of time.

▸ Pricing:

For the basic plan, ₹ 85 /User/Month for more than 50 employees.

For the Professional plan, ₹ 115 /User/Month for more than 50 employees

For the Enterprise plan, Pricing for enterprise users is available on demand.

▸ Google Rating

- n/a

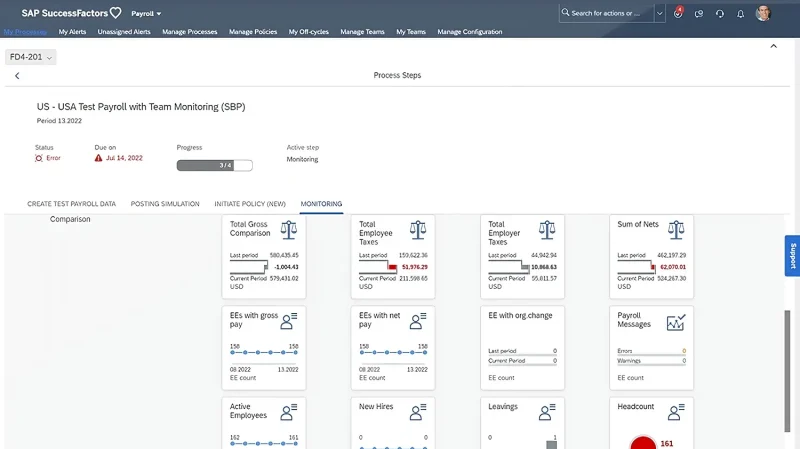

8. SAP SuccessFactors

SAP SuccessFactors is a cloud-based payroll software that ensures a user-friendly payroll solution with streamlined tax filing features for employees. It prioritizes smoothed employee payroll, accurate talent management, HR analytics, outstanding workforce planning, personalized employee experiences, etc. It has over 235 million users in over 2000 countries and has been a SAP family since 2012.

▸ Key Features:

- Smooth Workflow management

- Automated Compliances

- Effective event management

- Offline accessibility

- Outstanding organization management

- Smooth shift scheduling

- Effective and user-friendly salary structure

- Userfriendly and attractive mobile user interface

- Quick candidate identification and performance tracking facilities

▸ Ideal For

Businesses with Indian and Multinational companies

International Business

Small, medium-sized, big businesses

▸ Advantages of SAP SuccessFactors

SAP SuccessFactors provides a comprehensive view of the workforce.

User-friendly self-service payroll features for every individual employee

Provides international accessibility for every candidate

Super clarified features like performance tracking, tax calculations, and task assignments, etc.

Acceptable local variance at every individual geographic location specifically for the other countries and regions.

▸ Disadvantages of SAP SuccessFactors

Lacks of transparent pricing

No option for free trials

Can be pricy for SMEs

Doesn’t support heavy customization

▸ Pricing

- Pricing for users is available on demand.

▸ Google Rating

- n/a

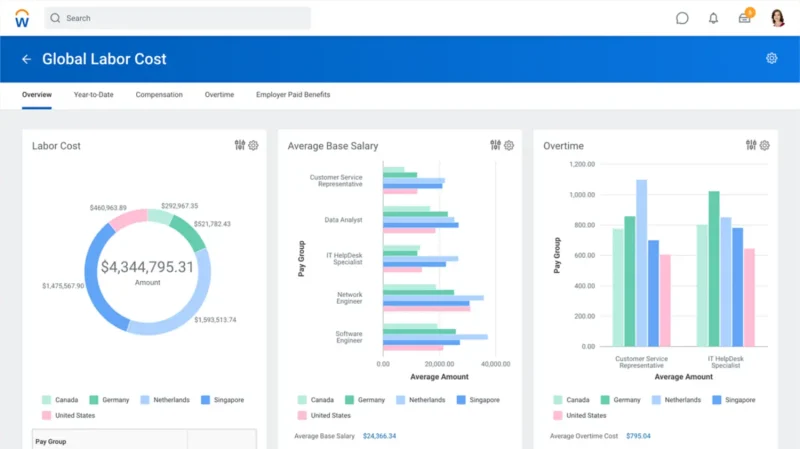

9. Workday HCM

Workday HCM is a cloud-based payroll software in India designed with artificial intelligence and machine learning. It ensures a streamlined and autogenerated payroll process, workforce planning, talent management, onboarding and other compliance-related processes like tax filing, tax review and analysis etc. Along with the comprehensive feature, it provides services worldwide. Users can use it for international business purposes.

▸ Key Features:

- In detailed employee data management

- High-end security

- Reliable performance management

- Proficient employee attendance management

- Efficient reporting

- Userfriendly user interface

- Multilingual facilities

- Smooth and auto salary structure

▸ Ideal For

Internation business

Big enterprises.

Mid-range company

▸ Advantages of Workday HCM

WorkdayHCM can be subscribed for more than 1000 employees together

Users can get international salary transactions through this software

Efficient employee data management

▸ Disadvantages of Workday HCM

Complex Interface

The price is a bit expensive

Not so up-to-date, less userfriendly

▸ Pricing

Pricing for users is available on demand.

▸ Google Rating

- n/a

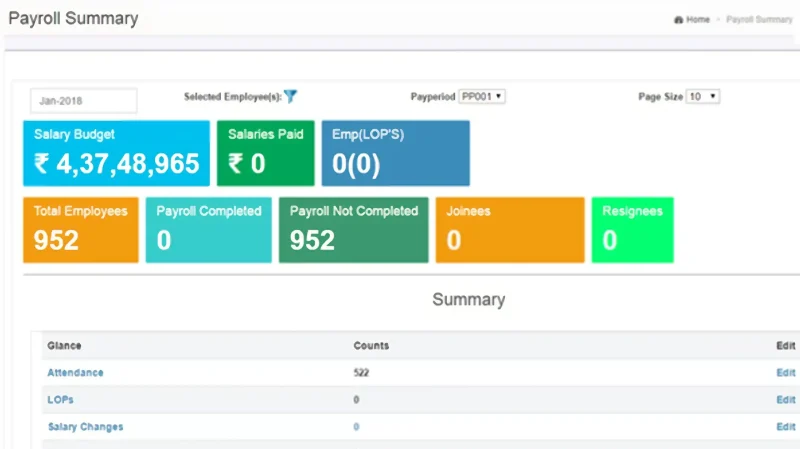

10. 247HRM

247HRM is another significant core HR system provider that is a complete hire-to-retire payroll solution. It is designed with high-end features like streamlined payroll management, efficient time tracking, on-time automated performance appraisals, and more. It ensures precise product and training manuals for every individual in payroll issues, tax management, tax declarations, and other PF, Employee profiles, and Salary revision-related issues.

▸ Key Features:

- Smoothed HR automation process

- Efficient employee self-service portal

- Proactive Performance management and analysis system

- Accurate payroll calculation and income tax management system

- Efficient Payroll management system

- Leave management system

- Attendance management system

- Seamless performance management system

- Streamlined Expense management system

- Proper Timesheets arrangement

- Transparent Talent management system

▸ Ideal For

Retail Industries

Automobile Industries

Manufacture Industries

▸ Advantages of 247HRM

Userfriendly, Highly Intuitive and fully updates

All Compliances rules and strategies are handled rightly

Satisfactory customer support

▸ Disadvantages of 247HRM

Complex UI interface

Load time more than expectation

▸ Pricing

- There are options like 247HRMseed, 247HRMshoot, 247HRMsapling, and 247HRMplants for every 30 employees. Pricing for all options for users is available on demand.

▸ Google Rating

- 4.4 out of 5

15 Best HR Software in India 2025 (Detailed Review)

Top 8 Features of Payroll Software

1. Payroll Processing

Payroll processing ensures employees’ salaries are credited correctly within time. The entire payroll processing features include calculating employee tax information, collecting employee attendance, payment scheduling, deducting, disbursing gross/net pay, and generating payslips.

2. Payroll Auditing and Error Reporting

With the payroll auditing and error reporting process, organizations perform real-time auditing of employee data and cross-verify data against the company’s rules and regulations. Along with this, the feature helps employers track audit trails and maintain a transparent and trackable history of employee payroll transactions.

3. Tax Compliance and Filing

Payroll software takes the responsibility of maintaining compliance guidelines and handling employee tax filing. With features like automated tax calculation, the software generates forms by pulling employees’ tax-related information and performing auto payroll tax filing. It ensures central and statewide payroll tax rates as well. Additionally, the software also helps to gather entire central and state compliances so that the company don’t face any issues related to penalties, lawsuits and other judgements.

4. Smooth ESS portal

Smooth ESS portal provides employees with the freedom to see, understand and analyse payroll details and other salary relation information. Using this software feature, employees can get updated payment- tax-related information, download the monthly payslip, or other details like PF anytime, anywhere. Through the ESS portal employees perform payroll, attendance, and performance-related open communication within the workplace.

5. Benefit Management and Rewards

Benefit management ensures seamless benefits like a health insurance plan, retirement plans, bonuses and other incentives for employees’ excellent performance. With this process, organizations maintain employee perks and welfare within the workplace.

6. Data Security

The payroll software is compiled with industry rules, regulations and other data protection rules like automatic data backups or disaster recovery mechanisms ensuring data integrity. Moreover, High-level data security in payroll software provides a multi-level defence strategy, assured confidentiality, integrity, and other payroll-related sensitive information.

7. Expense Management

With the help of expense management tools, organizations can easily track, submit and reimburse employee expenses. It helps employers understand and analyse employee expenses, categorise them, and reimburse the amount to them smoothly. Expense management system also ensures spending patterns, and accurate reimbursement and deduction calculations and enables better financial control and strategic decision-making.

8. Year-End Processing

Payroll software automates the year-end payroll processing. The payroll automation includes annual tax forms such as W-2s and 1099s for tax reporting, bonus payment disbursal, auto tax regulations, withholding rates, or other employee and payroll regulations.

Top 7 Advantages of Using Best Payroll Software

Here are the key advantages of using the best payroll software in India,

1. Time Savings

Payroll software provides features like automation, and streaming the entire HR practices. HRs take time to calculate wages, taxes, deductions, and many more. The automation feature of Payroll software not only minimizes the chance of errors but significantly speeds up the payroll process.

2. Accuracy and Compliance

Payroll software provides accurate and error-free payroll processes by automating complex payroll and tax calculations/filings. It also helps businesses by staying updated with frequently changing tax laws and regulations, reducing the risk of costly penalties and legal issues.

3. Cost Savings

The entire payroll-related challenges like the risk of errors, misplaced data, and data breaches while performing tasks like manual data entries and paperwork are eliminated by the payroll software automation. It will lead to cost savings that will help avoid financial discrepancies. This efficiency will contribute to overall operational cost reduction.

4. Employee Self-Service

Payroll software solutions offer employee self-service portals. It allows users to access and manage their payroll-related information like understanding salary details, analysing PF, calculating bonuses or incremented percentages, tax filing, etc. It promotes transparency and empowers employees to address their payroll-related queries independently.

5. Reporting and Analytics

Payroll software ensures features like robust reporting and analytics by using updated tools. It provides valuable insights into business-like payroll expenses, trends, and employee costs. This data can aid strategic decision-making and budget planning.

6. Integration with HR and Accounting Systems

Seamless Integration with HR and accounting systems allows for streamlined data flow between departments. It ensures uniformity in employee information and related financial data.

7. Security and Data Protection

Payroll software provides high-end security that protects sensitive employee information and financial data. It includes features like data encryption, access controls, and regular security updates to help safeguard against data breaches and unauthorized access, ensuring the confidentiality and integrity of payroll-related data.

Why do Companies Need Payroll Software for Business?

Though a company have the Best HRMS Software in India, they must need something unique for smooth payroll practices, so that the entire finance structure stays streamlined and employee get their payment on time. Here are the following reasons for integrating payroll software into the business;

Payroll software automates and brings accuracy to the calculation process during salary disbursal, tax filing, deduction and other financial components. Using the software organizations get error-free employee payroll data on time without attending manual calculation and analysis.

Payroll software improves the entire payroll process and related work, while also automating employee tax filing and other compliance-related issues. HRs and employers can focus on strategic tasks more than wasting time in payroll data entry, calculation and processing.

Keeping statutory compliance up-to-date can be one of the main reasons for integrating payroll software in business. It helps businesses stay compliant and updated with local and national tax regulations, labour laws, and other statutory requirements. It can generate reports needed for tax filings and audits.

Payroll software comes with outstanding features like employee self-service portals for users. Using the features users can access their entire payroll details like reviewing and downloading the payslip, view their recent salary status, TDS details, and other relevant information. It reduces the burden on HR for routine queries.

Payroll software aggregates all the national and state-related compliances together so that employers do not have to face any challenges related to non-compliance. It automates the tax filing process and maintains other tax-related tasks and information. So that HRs do not have to face trouble in auto tax filing and management.

Payroll software provides high-end data security features which ensure sensitive employee data protection by maintaining confidentiality according to data and compliance protection rules and regulations.

Payroll software provides detailed insight into payroll data and ensures autogenerated employee reports and other statutory reports to the employees. Additionally, the audit trail helps businesses maintain transparency and easily track changes made to payroll information.

Top Factors of Selecting the Best Payroll Software for Business

Here are some important factors, users should know before purchasing any online payroll software India;

1. Understand Business Requirements First

Before jumping into any decision, understanding your business requirements is essential. Pile up some questions like, what they provide, and does their plan match our needs? What is the extended budget amount? or does it provide any trial version of the system, etc? It helps you select the appropriate software for your company.

2. Enquire Required Features

Understanding the types of facilities you require for your payroll solution is important. Before integrating it is essential to check for key functionalities like automation in salary disbursal, swift wage calculation, tax filing capabilities, expense handling, mobile accessibilities and more.

3. Check for Trial

Checking for trails is essential before software deployment. In this phase, you can understand whether the software aligns with your following requirements.

4. Budgeting

If the provided features are tempting and smoothly aligned with your requirements during the trial period, you should inquire about the cost-effective solution from the software solution provider. However, the robust options might be pricier.

5. Deployment

After the negotiation process, you can deploy the payroll software for your company. During the phase, users configure according to the needs of the business by setting up the system parameter, integrating with the existing HRMS software, etc. The section ensures smooth transactions to the new payroll system, commencing effective communication with stakeholders, etc.

6. Support

After deployment, Providing feedback is essential as the reviews from recent users can be helpful in your software selection or further feature updation. Users can submit reviews to platforms like IndiaMart, SoftwareSuggest, and G2, etc.

Frequently Asked Questions (FAQs)

Which is the Best Payroll Software in India in 2025?

Pocket HRMS is the best payroll software in India as it is the only payroll software that comes with ‘smHRt® Payroll’ in India. The smHRt® payroll system analyses your employees’ payroll data and, with the help of machine learning, highlights any inconsistencies in the inputs. It enables your payroll team to handle any errors in the payroll input data before processing it, ensuring complete accuracy and efficiency in your payroll process.

How much can Payroll Software cost in India?

Many companies are moving to cloud-based payroll solutions to avoid handling confusing spreadsheets. From start-up companies to enterprises, everyone is looking for some affordable payroll software solution. In general software pricing is divided into three phases. Here is a broad overview of the potential cost ranges for Indian payroll software:

Small Businesses (Up to 50 employees)

– Monthly Subscription: ₹500 to ₹5,000 per month

– Annual Subscription: ₹6,000 to ₹60,000 per year

Medium-sized Businesses (50 to 500 employees)

– Monthly Subscription: ₹5,000 to ₹20,000 per month

– Annual Subscription: ₹60,000 to ₹2,40,000 per year

Large Enterprises (500+ employees)

– Custom Pricing: Large enterprises may have custom pricing based on their specific needs, and the cost can vary significantly.

What are the Top Free Payroll Solutions in India?

Though you can not get all three plans of payroll software free, however, some software solutions provide free basic plans as a trial. Let’s explore the free payroll software in India. Keep in mind the basic plan can be free, but if you want some unique payroll feature, you have to buy it.

1. Zoho payroll

2. Qandle

3. Saral paycheck

4. Wallet HR

5. Sum HR

6. Kredily

7. Facto HR

How is Payroll Software effective for Businesses?

Saving employers time by eliminating manual payroll calculation.

Providing accurate error-free employee payroll data

Providing the opportunity to enjoy simplified payroll practices

Ensuring auto tax filing and bringing ease in compliance

Saving running costs by automating the entire payroll process

Involving employees in using their employee self-service portals

Is there any Yearly Maintenance Fee for maintaining Payroll Software?

Many payroll software providers charge an annual maintenance fee for covering updates, integrating new features, managing add-ons, and more. On the other hand, some are not. This fee includes rechecking, revamping the existing features of the software, integrating recent updates and training the users by introducing them to the new features.

Here is a list of top payroll software (India) that take maintenance fees from the users.

SAP SuccessFactors

Oracle payroll cloud

Quickbooks Online Payroll

ADP workforce

Before jumping into proceeding with the maintenance fee, every user needs to review the terms and conditions of the software agreement and understand the specifics of any maintenance fees attached to their chosen payroll software solution.

Disclaimer:

The order of software listed in the blog does not intend to rank software based on function, price or performance. The intent of the blog is to inform the readers about various available options to help them make an informed decision.