Full and Final Settlement

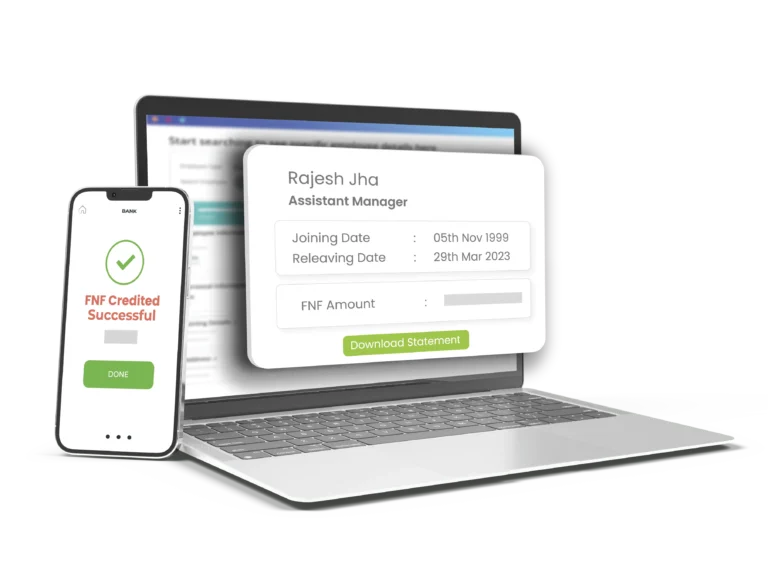

Automate your FnF Settlement with robust software for enhanced efficiency and smoother employee exit.

FnF Settlement Guide

What Is Full and Final Settlement (FnF)?

Full and Final Settlement (FnF) is the process of calculating the amount owed to employees who leave an organization. It ensures that all dues are cleared, including salaries, bonuses, incentives, etc.

FnF is essential in the HR workflow as it helps them evaluate and pay employees’ dues after their exit from the organization, resulting in satisfied employees, and enhancing the company’s image. When an employee completes their notice period by handing over their documents, assets, and knowledge acquired during their term of service along with no contractual obligation, they are entitled to receive the full and final settlement clearance from their company.

What are the rules for Full and Final Settlement?

According to the Payment of Wages Act 1936, an employee is entitled to payment according to their terms of service. During the FnF process, certain State Laws like the Commercial Establishment Act, Wage Code, New Wage Code, Labour Law, etc., should also be referred to.

Ideally, the maximum duration for undertaking a full and final settlement is 30-45 days after the last working day of the employee. However, organizations are free to pay their employee within this period, and modern organizations have started adopting 2-3 days FnF settlements through the use of HRMS software.

Step-by-Step Full and Final Settlement Process

The process of Full and Final Settlement is conducted according to the specifications of the company’s policies. A general flow of the FnF Settlement Process is:

Step 1. Resignation Acceptance

Accepting the employee’s resignation is the first step of the full and final settlement process in which the company accepts the request of the employee to leave the organization. Giving a response to the resignation showcases the ideal conduct of management towards human resources.

Step 2. Sharing Acceptance Letter

After receiving the resignation letter from the employee, the employer sends an acceptance letter to acknowledge the exit date and commence the process of full and final settlement accordingly.

Step 3. Assets Handover

The next step is the handover of all official gadgets and access cards provided to the employee during their term of employment with the organization. The employees are expected to return the assets intact along with any credentials.

Step 4. Collecting Clearances

Different departments like IT, HR, Finance, and Admin provide clearances after verifying the recoverable from the employee. It ensures zero data theft and maintains the confidentiality of the company.

Step 5. FnF Settlement Letter & Service Certificate

After getting the required clearances, the full and final settlement is processed and released within 30-45 days of the employee’s exit. Additionally, an experience certificate is also provided to the employee for investing their knowledge and skills in the company.

Components of Full and Final Settlement

The major components of Full and Final Settlement include:

1. Unpaid Salary

Unpaid salary is the outstanding wages of the exiting employee that are not paid during their employment. Salary earned during the notice period or any arrears due from the preceding month of employment are considered unpaid salary.

2. Additional Earnings

It includes various allowances and bonuses provided apart from the basic employee’s salary during their term of service like:

Personal Development Allowance

Transport Allowance

Leave Encashments

Statutory Bonus

Additional Incentives

Redundancy Pay, and more

3. Gratuity

The Payment of Gratuity Act of 1972 has laid certain rules for the payment of gratuity amounts. It is paid to employees who have completed 5 years of continuous term in an organization.

By law, the government has made it mandatory for organizations to pay gratuity within 30 days of an employee’s exit; otherwise, a simple interest is required to be paid from the due date till the date of payment by the employer.

Companies deduct 4.81% from the employee’s salary and pay it during the exit of an employee as the gratuity amount. As the gratuity paid to employees is a part of their salaries, it is eligible for income tax deductions. However, it is subject to limited deductions due to various exemptions laid by the government.

4. Deductions

Any tax liability that is eligible for income tax is deducted from the full and final settlement payment. Under the Income Tax Act of 1962, a TDS (Tax Deducted at Source) is deducted from the components that are qualified for taxation. These deductions include PF, ESI (if applicable), income tax, etc. However, gratuity and leave encashments are exempted from TDS.

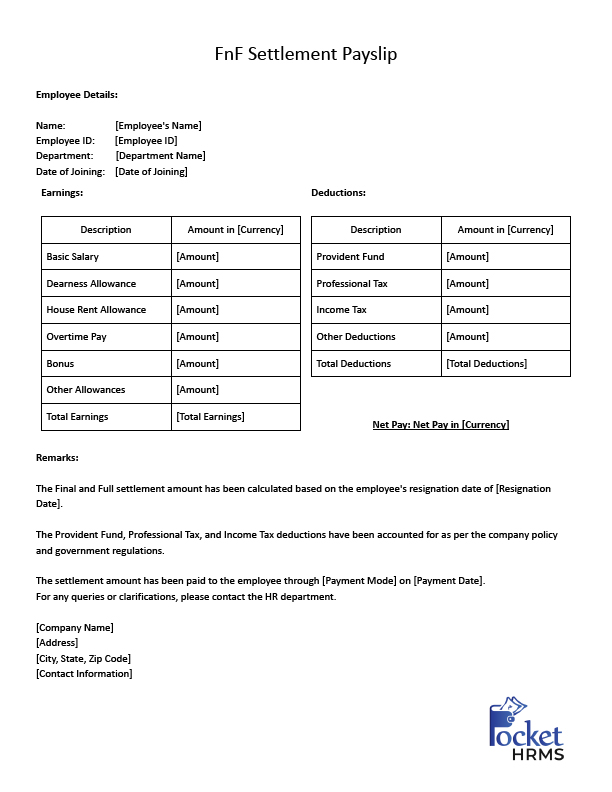

Full and Final Settlement Format of Payslip

The FnF settlement format for payslip does not have any specific format to be uniformly followed by all the establishments.

The basic full and final settlement payslip includes the following details:

Name of Employee

Designation of Employee

Employee Code

Bank Account Number

No. of LOP Days

No. of Paid Days

Full and Final Settlement Components Evaluation

Total amount to be received excluding the exact tax deductions, payable taxes and other deductions.

All the transactions of the FnF settlement process (including deductions and additions from net salary, gross salary, and more).

Full and Final Settlement letter

Clearances Required to Process the FnF

The full and final settlement process involves multiple steps to attain clearance from numerous departments.

A company is composed of diverse departments and when an employee decides to exit, they have to get clearance from the concerned departments to get their full and final dues.

The departments responsible for making clearances generally include IT, administration, HR, and finance departments.

1. IT Department Clearance Specifics

The IT department is responsible to collect all the official gadgets and login IDs that were provided to the employee for the duration of their service.

Recovery of company assets includes mobile phones, laptops, and other gadgets provided to the employee during the term of their employment.

The department should ensure the gadgets are robust and there are no damages. Besides, access to all official logins is blocked.

In case of non-recoveries, the IT team can stop the FnF processing and in case of damages, it can recover the damaged amount from FnF.

2. Admin Department Clearance Specifics

The Administration department is liable to collect the identity cards or other access required for the entry and exit of the employee.

The admin head is the responsible person who verifies the entire process of recovery and has the authority to let up the processing of full and final settlement payment until recovery.

3. Accounts Department Clearance Specifics

The Finance team is accountable to process all the balance payments in the FnF settlement process after making necessary deductions and additions (if any).

Various components are taken into consideration while calculating the FnF like the outstanding expenses, expenses on the company’s card, additional expenses incurred, and others.

4. HR Department Clearance Specifics

After the notice period is duly served by the employee, The HR team signs the last document confirming the handover of all assets and clearance from all the departments.

The HR department has the final job of processing the FnF settlement.

Documents Required During FnF Settlement

The 5 essential documents that are necessary during the full and final settlement are:

1. Resignation letter

The first and foremost document that is needed for full and final settlement is the resignation letter of the employee. There should be a formal resignation letter submitted to the employer by the employee mentioning the last working day, reason for exit, and commitment to hand over the company’s assets and knowledge before leaving.

2. No Dues Certificate

no dues certificate is a document indicating that the exiting employee or employees have cleared all their dues with various departments like finance, IT, HR, and administration. Diversion to which shall withhold their no dues certificate resulting in the delay of fnf settlement.

3. Attendance and Leave Details Records

A comprehensive report on unused paid leave is required to pay the leave encashment dues, further, the attendance of the employee is evaluated to calculate the number of working days attended by the employee during the period of notice. Any leaves availed during the notice period are subject to deductions, etc.

4. Asset and Access Rebound (Handover)Form

A return checklist form of all the assets and accesses that in in possession of the exiting employee. The list is thoroughly checked to ensure that all the company assets such as laptops, phones, etc are operational and are duly returned by the employee. Further, the login access of the employee is revoked.

5. Finance Sheet

A final finance calculation sheet depicting the breakup of the final settlement amount which includes salaries, deductions, bonuses, compensations, benefits and leave encashment, etc.

Wrap Up

The FnF settlement procedure is a tedious process for the payroll team specifically since its evaluation of adding the cash benefit, calculating the face salary deductions, and more. Automation in the FnF settlement procedure not only quickens the process but also eases the task and benefits in managing time better. FnF is calculated on the regular salary schedule and a streamlined FnF procedure exemplifies the vigorous and supportive management team. After getting an insight into the f&f meaning, fnf full form and its significance, you should select the best HRMS that will be a boon to your HR’s processes and will enhance the efficiency of the full and final settlement process to optimum.

FAQs

The full form of FnF is full and final settlement. It refers to the process to clear the dues of employees which includes their salaries. unused paid leave encashments, bonuses, compensations, deductions, etc.

The timing of full and final settlement (fnf) varies as per different company policies, employment contracts, labor laws obligations, etc. However, it has generally been processed after the last working day of the employee. The essentiality of the full and final settlement letter is to ensure that all the financial dues and obligations between the employer and employees are fairly resolved.

The full and final settlement time period is the time within which the employer is liable to clear the dues and obligations of the exiting employees. Although there is no specific time mentioned in the Payment of Wages Act 1936, as per experts, the ideal time period to complete fnf should be somewhere between 30-45 days after the employee’s last working day. Some organizations take 90 days after the last working day of the employee for fnf settlements.

However, as per the Payment of Wages Act 1936, in case of termination of employees, the employer has to clear the fnf within 2 working days after termination. As per the Factories Act, of 1948, the used leave encashments and bonuses must be cleared by the 7th or 10th of the following month after the resignation of the exiting employee.

If the employer fails to pay the full and final settlement even after fair compliance with exit rules by the employee, then the employee can sue the organization in a court of law and can also approach the labor commission. If the employee is avoided after the exit and the employer intentionally stops the process of fnf then the employee can lodge a complaint to police against the employer.

Under the New Wage Code, employers are required to clear the fnf settlement within 2 days of employee’s last working days. Earlier it was settled within 30-45 days or 90 days of employee’s last working days, but now the new laws have mandated companies to pay the fnf within 2 days of employees exit.

Yes, gratuity is included in the full and final settlement. It is a major component that is evaluated in the process of fnf. Under the Payment of Gratuity Act, of 1972, Gratuity is paid to employees who have completed 5 years of continuous term in an organization without any gap in between. Most companies deduct 4.81% from the employee’s salary and pay it during the exit of an employee as the gratuity amount.

The HRMS software can ease your fnf settlement in multiple ways such as:

1. Automation

The HRMS software automates the offboarding process by accelerating the exiting formalities and tasks. The quickening of the process facilitates the employers’ ease in calculating the fnf settlement conveniently with efficient reports and analytics.

2. Error Free Evaluations

The best part of HR software is it automates the evaluation of the fnf components hence eliminating the scope of manual errors. It provides error free reports that is reliable for further processing and dues clearance of employees.

3. Easy Collaboration

The HRMS software collaborates with other systems such as attendance management system (GPS attendance system, biometric attendance system) leave management system, and payroll software to extract accurate data such as the total number of leaves taken by the exiting employee from the date of resignation to the last working day, exact location and time of clock in and clock out from the work location, etc, that are required for the evaluation of fnf. This as a result helps in the extraction of credible and error-free fnf reports.

4. Compliance

It helps to comply with the labor laws that state clearance of all dues of exiting employees within 2 days of the last working day. It can be achieved only by the company which has automated fnf management that streamlines the offboarding tasks and fastens the process.

5. Notifications and Alert

The HRMS payroll software notifies the full and final settlement dates and alerts the employer to process the dues within the time frame hence facilitating compliance within the time frame and strengthening the image of the company in the market. The ESS portal (Employee self-service portal) of employees enables them to view any clearances or handover due from the employee before their exit, hence notifying them about the clearances before they leave. This proactive approach helps eliminate potential issues and delays in the FnF process after the employee has left the company.

Yes, taxes are deducted from the full and final settlement amount. However, specific deductions depend on various factors, including the nature of the payments made in the settlement, the employee’s salary structure, and the applicable tax laws in the country, etc. Various components of fnf settlement like Provident Fund, ESI (if applicable), Employee’s Income Tax, etc. are taxable whereas gratuity and leave encashments are exempted from TDS.

Yes, a full and final settlement is mandatory for all the employees who comply with the company’s exit policies and cooperate in making the transition happen with ease. Irrespective of the type of exit by resignation, termination, etc. employees have the right to get their dues cleared with the organization, subject to the condition they adhere to the policies, obligations, and exit formalities duly.

According to Indian Labour Laws, Full and Final settlement should be completed within 2 days of the last working day of the employee. It is common practice for Indian organizations to provide FnF within 30 to 45 days from the last working date. However, if they fail to provide it even after 45 days, the employee can take legal action against the company.