The salary slip is one of the most important documents for an employee. Your salary slip provides an accurate classification of the earnings and deductions across various salary components, while also serving as proof of employment. It is shared with the employee every month as it informs them of their earnings and deductions for the month.

Since a salary slip contains all the information related to the employee’s salary, it is kept confidential within payroll software. It contains various information related to the employee and their employment, such as their employee ID, company name, designation, bank details, and more.

Hence, let us check out the salary slip format with the help of a few templates and understand the various components of a salary slip.

What is Salary Slip?

The salary slip is a document shared by the employer to their employees informing them of the amount they will be receiving for a specific salary cycle.

Hence, a salary slip is shared with employees every salary cycle, which provides them with the exact amount they will be receiving in the form of earnings and deductions, including the statutory and other deductions. Modern organizations have automated the process of sharing payslips by letting their HRMS or payroll systems share the soft copies using the ESS portal, mobile app or via emails.

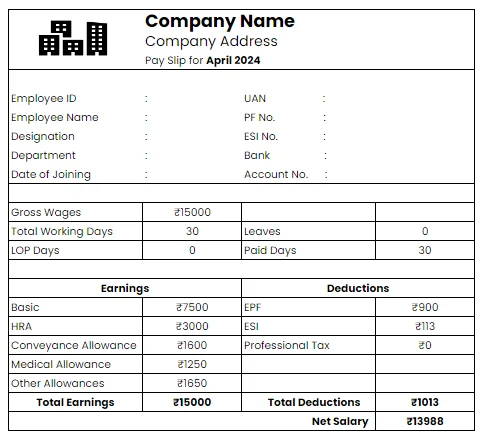

Salary Slip Format

The salary slip format includes multiple company details like company logo, name, employee details, payment period, salary components, etc. It provides a clear understanding of each component of the employee’s salary to ensure complete understanding.

Download Different Salary Slip Formats

We have provided a basic salary slip format for your reference here; feel free to download and edit it according to your needs. We have also provided the salary slip formats in Microsoft Excel (.XLSX), Microsoft Word (.DOCX), and Portable Document Format (.PDF):

Download Simple Salary Slip Format in Excel

Download Simple Salary Slip Format in PDF

Download Simple Salary Slip Format in Word

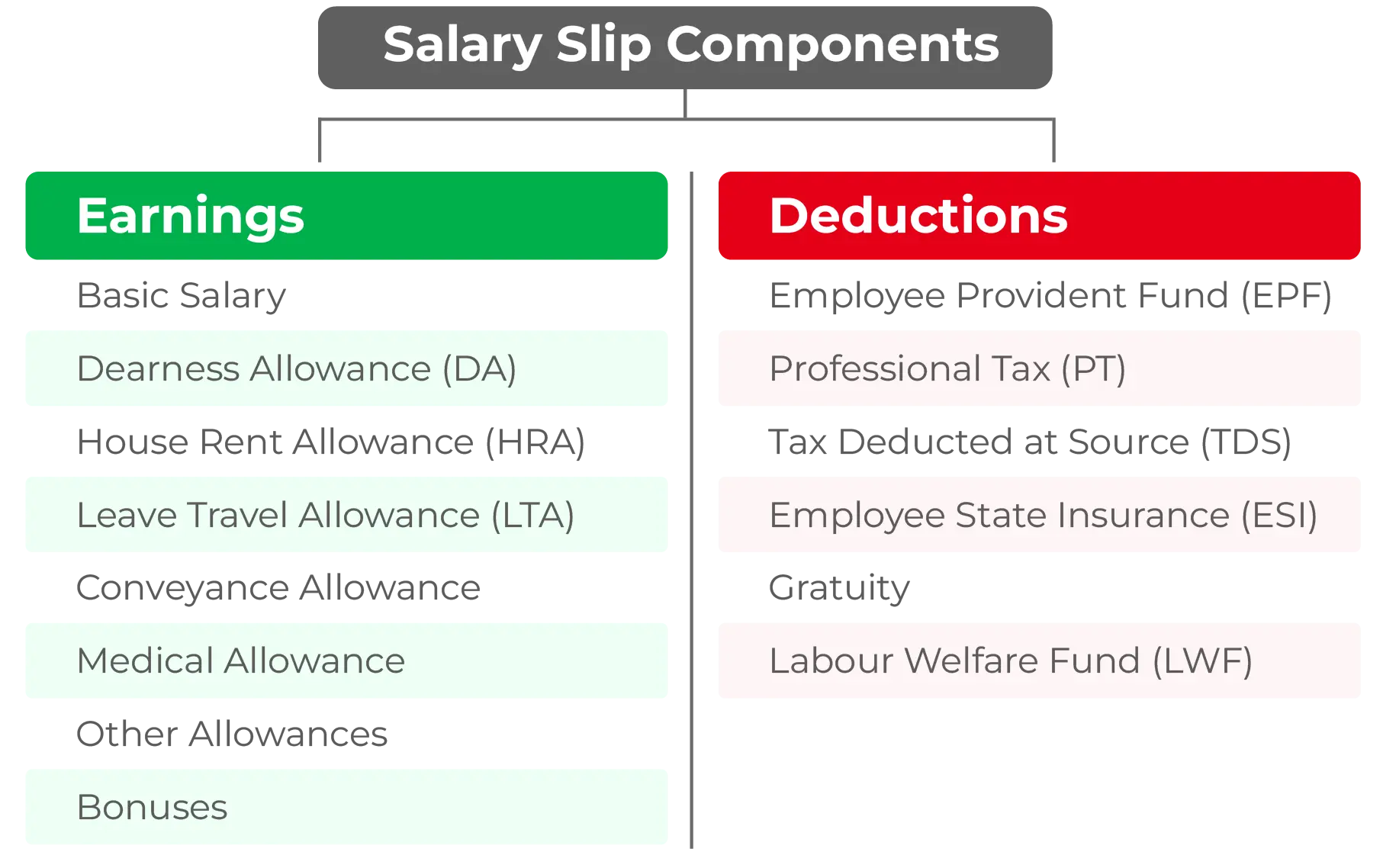

Components of Salary Slip

Since salary slips are essential for employees and employers, it is essential to understand the salary slip format and the various components of salary slips. Having a clear understanding of these components in a payslip will help in consulting with the HR teams to tweak it for maximum tax savings as well as planning for investments.

Hence, let us understand these components in a payslip better:

1. Earnings

Earnings are the components that you receive in your compensation. They include:

➔ Basic Salary

Basic salary is the most important component of the salary since the other components are calculated as a percentage of it. Hence, it is usually 35% to 50% of the overall salary, with companies varying their percentage based on various factors. The basic salary is often relatively higher in junior positions, with allowances becoming more significant as the employee gets promoted.

➔ Dearness Allowance (DA)

Dearness Allowance is the component of the salary used to deflect the effects of inflation on the employees’ lives. Hence, it is usually 30 to 40 per cent of the basic pay. Since it is based on the cost of living at different locations, a company may provide different DA to similarly designated employees with similar work experience, living in different geographical locations.

➔ House Rent Allowance

The house rent allowance is provided to employees living in rented homes. For metro cities in India, the HRA is defined to be 50% of the basic pay, while it is 40% of the basic pay for other cities. Employees can claim tax exemption on the HRA, up to a certain limit, provided they can declare their rent agreement details.

➔ Leave Travel Allowance (LTA)

Leave Travel Allowance is provided to the employee to help them undertake leisure trips. Hence, it is meant to promote family time and a healthy work-life balance. LTA covers the travel expenses of the employee’s immediate family members as well. However, tax exemption on LTA is allowed only for 2 journeys undertaken over 4 years.

➔ Conveyance Allowance

The conveyance allowance is provided to the employees to help with their daily commute to the office. It is exempt from income tax either up to ₹ 1600 per month or the actual conveyance allowance received by the employee. Hence, it helps the employee manage their daily commuting effectively.

➔ Medical Allowance

Medical allowance is the amount paid to an employee to cover their medical expenses. Hence, the medical allowance is exempted from income tax – up to ₹ 15000 per annum – only if they submit the medical expense proofs. The medical allowance encourages the employer to take care of employee well-being and ensure a safe workplace for their staff.

➔ Other Allowances

Apart from the allowances discussed above, employers may choose to provide their staff with additional allowances. These include overtime allowances, special allowances, performance allowances, and more. It is completely taxable and hence, employers provided a bifurcation of the same in the salary slips.

➔ Bonuses

Bonuses have been a part of the employee salary structure since the introduction of statutory bonuses. An employer can also pay ex gratia payment as a bonus to their employee for excellent performance. In both cases, these details should be included in the salary slip since it is a part of the employee’s earnings for the current salary cycle.

2. Deductions

Deductions are also included in salary slips to help the employee understand the various components the company has deducted from their salaries. These include:

➔ Employees Provident Fund (EPF)

The employee provident fund is a fund managed by the government for the benefit of the employee. The employee and the employer are required to pay the Employees’ Provident Fund Organization (EPFO) equal contributions an amount that is 12% of the employee’s basic salary, each salary cycle. Hence, the employee contribution for EPF is deducted from their salaries.

➔ Professional Tax (PT)

The Professional Tax (PT) is a pre-defined amount levied by the state governments on employed individuals, and hence, it is payable only within some states in India. Since it is deducted from the employee salaries, it is mentioned in the employee salary slips. Professional tax is levied on both employed individuals and businesses.

➔ Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is the amount deducted by the employer to pay towards the employee’s income tax. The employer is responsible for deducting the amount when paying the employee and depositing it with the government. Employees can reduce the deductions by investing in equity funds such as PPF, NPS, ELSS, etc.

➔ Employee State Insurance (ESI)

Employee State Insurance (ESI) scheme is a social security scheme provided by the government, that helps the employees financially whenever required. It is mostly used for financial aid during medical emergencies, making it crucial for employee well-being. The employee is required to contribute 0.75% of their basic pay, while their employer is required to pay 3.25% of the employee’s basic pay towards ESI.

➔ Gratuity

Gratuity is the amount provided to an employee for their prolonged services in an organization. It is governed by the Payment of Gratuity Act, 1972 for Indian employees. Indian employees are provided with gratuity once they complete 5 years in an organization, and in cases where they get disabled due to an accident, injury or disease.

➔ Labour Welfare Fund

The Labour Welfare Fund is a statutory deduction towards the Labour Welfare Fund, which is managed by the Labour Welfare Board of different states. Hence, the difference between the amount and frequency of deduction are also determined by the individual states. Similarly, it does not apply to all staff members since it is mainly geared towards factory workers.

Formulae in Salary Slip Format

There are various formulae used in calculating the numerous components of salary slip format. These formulae ensure accurate calculations for determining the various components of the employee salary structure.

Hence, we are sharing some of the most relevant formulae in salary slip format:

- Cost To Company (CTC) = Gross Salary + Employee Provident Fund (EPF) + Gratuity

- Gross Salary = Basic Salary + House Rent Allowance (HRA) + Other Allowances

- Net Salary = Basic Salary + House Rent Allowance (HRA) + Dearness Allowance (DA) + Other Allowances – Income Tax (IT) – Professional Tax (PT) – Employee Provident Fund (EPF).

Importance of Salary Slips

Salary slip is essential for employees, as it helps them understand the various components of their salary such as the basic salary, gross salary, various allowances, bonuses and incentives, and more. It is also relevant for the employers as it helps them maintain accurate salary records.

However, it has other relevance apart from its primary intent, such as:

1. Precise Salary Understanding

Salary slips usually have a tabular or a pictorial display of the various salary components, which informs the employee of the various components of their salary and the exact amount they will be receiving for a specific salary cycle. By understanding their salary structure better, employees can optimize their expenses to stay within budget, while also cultivating healthier investing and saving habits. It also provides information on overtime pay, which would be calculated based on the data provided by the timesheet management software.

2. Employment Proof

A salary slip is proof of the amount an employee is entitled to by the company that has employed them for the duration mentioned in the salary slip. Hence, it acts as proof that the employee worked in the company, which can be useful in cases where the employee has misplaced their relieving letter. It is also considered in various official contexts, such as attesting your employment status while applying for visas, or university admissions, as well as in clearing background verifications in organizations.

3. Income Tax Planning

Salary slips also serve the essential purpose of helping employees plan their TDS returns and other statutory obligations. Empowered with the knowledge of the individual factors that affect their taxes, they can maximize the benefits they receive from rebates, allowances, and more. Such effective planning strategies help optimize employee savings and investments using the gross salary, by ensuring maximum tax savings.

4. Credit Management

When applying for various credit schemes such as loans and credit cards, the institutions providing these schemes often require income proof, which can be fulfilled with a salary slip or a salary certificate. They also act as evidence for stable income, which is relevant for financial institutions providing credit schemes to their clientele.

5. Salary Negotiations

Armed with the knowledge of the numerous salary components, an employee can also negotiate their salaries effectively while being interviewed. Past salary slips can be instrumental in salary negotiations with future employers since they prove the worth of the employee.

6. Government Subsidies

A salary slip also determines your income slab, which helps in securing various government subsidies and schemes for the employee and their family. For example, it provides employees access to various State and Central Government schemes, which provide them with discounted or free services such as medical care, food, public transport, etc.

How to Design a Salary Slip?

The easiest way to design a salary slip is to download our salary slip format shared above. If you are a Pocket HRMS user, it is undertaken by our smHRt® Payroll system automatically, providing you with complete peace of mind.

However, if you are designing it from scratch, you need to ensure that the following information is available in it:

- Name and logo of the company

- Address of the company

- PAN and GST Number

- Employee’s name, ID number, and designation

- Employee’s date of joining

- Salary month information

- Employee’s PAN and bank details

- Number of days worked

- Number of ‘leave without pay’ days

- Gross salary, net salary, and deduction details

- Authorized signatures.

How can I get my Salary Slip?

Salary slips are usually shared by your HR once your salary is processed. However, if you have not received it, you should get in touch with your HR to procure it. While it used to be handed physically earlier, digitalization has ensured that it is shared digitally. Modern organizations often share payslips via email or provide the option to download them from their ESS portals.

Conclusion

A salary slip is a document which is crucial for the employee and the employer as it provides robust proof of employment by the employer. Also known as a pay slip, it also helps the employee understand the various components of their salaries, helping them plan their taxes. It also helps with requesting credit such as loans and government subsidies.

Hence, it is essential to have a good idea of salary slips and its format to understand its various components. That is why we have shared handy salary slip format templates in multiple file formats, which will help you quickly edit and tweak them to your requirements. Feel free to edit it by adding your company details and make it your standard salary slip format.

FAQs on Salary Slip

1. What is the difference between a Salary Slip and a Payslip?

‘Salary slip’ and ‘payslip’ are different names for the same document that provides detailed information about the earnings and deductions for a specific salary cycle.

2. Can I use my Salary Slip as proof of income?

Yes, a salary slip can be used as proof of income. Since it is an official document shared by the organization employing a worker, it is accepted as official proof of income even in several governmental institutions.

3. What Role Does a Salary Slip play in taxation?

Salary slip plays a crucial role in taxation as it provides a complete breakdown of an employee’s earnings and deductions, which also provides the amount deducted as Tax Deducted at Source (TDS).

4. What are the legal requirements for a Salary Slip Format in India?

Indian laws state that a salary slip should be shared with the employee every month, either physically or digitally, and that it should include a detailed breakdown of earnings and deductions. It should also be compliant with the Minimum Wages Act, Payment of Wages Act, and the Shops and Establishments Act.

5. How can payroll software help generate a Salary Slip easily?

Since payroll software calculates and processes employee salaries without manual intervention, it can also generate and share salary slips automatically. By automating this process, HRs and the finance team avoid any manual errors, which can prove costly.

6. What details are included in a salary slip?

The major details included in a salary slip are:

- Company Information: Company’s name, logo, address, PAN & GST number.

- Employee Information: Employee’s name, employee ID, designation, department, salary cycle, leave details, and bank account details.

- Earnings: Basic Salary, Allowances, Bonuses, Commissions, Arrears

- Deductions: Employee Provident Fund (EPF), Professional Tax (PT), Tax Deducted at Source (TDS), Employee State Insurance (ESI), and other voluntary deductions.

7. How can I download my Salary Slip online?

To download your salary slip online, you will need to log into your organization’s website or ESS portal. If your organization provides an app to manage your employment, you can also download your salary slip from the app itself.