Introduction

Tax Deducted at Source (TDS) refers to a collection of direct tax collected by Indian authorities according to the Income Tax Act, 1961. In other words, the tax deducted from an individual’s income on a periodic or occasional basis is known as Tax Deducted at Source (TDS).

The Central Board of Direct Taxes (CBDT), which comes under the India Revenue Services (IRS) manages TDS. TDS is applicable for the regular income as well as the income that is irregular in nature.

In this blog, we will understand the various aspects of TDS.

TDS Exemption

TDS is exemption is made in two cases:

- If the receiver has made the required investments mentioned in FORM 15G/15H by giving a self-declaration

- If the Assessing Officer provides the certificate of exemption.

Tax Rates in India

The tax rates in India varies as per several pre-set conditions. Hence, let us take a closer look at the tax rates in our country.

Normal Tax Rates for Individuals & HUF

Depending on the age of the resident individuals, the normal tax rates will be applicable. In the case of non-resident individuals, the tax rates will be the same as per their age. Individual tax applicability is classified as below:

-

- Resident Individual – Below the age of 60 years

- Resident Individual – Age of 60 years or above during the year, but below 80 years if age.

- Resident Individual – Age of 80 years and above at any time during the year. Non-resident individuals are irrespective of age.

Individuals

Other than senior and super senior citizen

|

Net Income Range |

Income-Tax Rate |

|

| Assessment Year 2021-2022 |

Assessment Year 2020-2021 |

|

| Up to ₹2,50,000 | NIL | NIL |

| ₹2,50,000 to ₹5,00,000 | 5% | 5% |

| ₹5,00,000 to ₹10,00,000 | 20% | 20% |

| Above ₹10,00,000 | 30% | 30% |

Super Senior Citizen

Who are 80 years or more at any time during the previous year

|

Net Income Range |

Income-Tax Rate | |

| Assessment Year 2021-2022 |

Assessment Year 2020-2021 |

|

| Up to ₹5,00,000 | NIL | NIL |

| ₹5,00,000 to ₹10,00,000 | 20% | 20% |

| Above ₹10,00,000 | 30% | 30% |

Non-Resident Individual / HUF

| Net Income Range | Income-Tax Rate |

Health & Education Cess |

| Up to ₹2,50,000 | NIL | NIL |

| ₹2,50,000 to ₹5,00,000 | 5% of (Total Income – ₹2,00,000) | 4% of Income Tax |

| ₹5,00,000 to ₹10,00,000 | ₹12,500 + 20% of (Total Income – ₹5,00,000) | 4% of Income Tax |

| Above ₹10,00,000 | ₹1,12,500 + 30% of (Total Income – ₹10,00,000) | 4% of Income Tax |

From Assessment Year 2021-22 and onwards, the payment of tax rates has been reduced for individuals and HUF:

| Net Income Range |

Income Tax Rate |

| Up to ₹2,50,000 | NIL |

| ₹2,50,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹7,50,000 | 10% |

| ₹7,50,001 to ₹10,00,000 | 15% |

| ₹10,00,001 to ₹12,50,000 | 20% |

| ₹12,50,001 to ₹15,00,000 | 25% |

| Above ₹15,00,000 | 30% |

What are the Types of TDS?

Listed below are some of the income sources that qualify for TDS:

- Salary

- Amount under LIC

- Bank Interest

- Brokerage or Commission

- Commission Payments

- Compensation on acquiring Immovable Property

- Contractor Payments

- Deemed Dividend

- Insurance Commission

- Interest apart from Interest on Securities

- Interest on Securities

- Payment of Rent

- Transfer of Immovable Property

- Remuneration paid to Director of the Company, etc.

- Winning from Games like a Crossword Puzzle, Card, Lottery, etc.

Which Sections can be claimed under TDS Deduction?

The following 14 sections are claimable for deductions in the amount of TDS:

|

Section |

Deduction |

Maximum Deduction Allowed Annually |

| 80C of the Income Tax Act | Deduction from total taxable income is claimable | ₹1,50,000 |

| 80CCC of the Income Tax Act | Deduction of premium paid for annuity plan of any | ₹1,00,000 |

| 80CCD of the Income Tax Act | Deduction Of employees’ contribution to pension account and employer’s contribution to NPS account | ₹2,00,000 |

| 80D of the Income Tax Act | Deduction of premium paid for medical insurance | ₹25,000 for self and immediate family and ₹50,000 if parents are above 60 years old |

| 80DD of the Income Tax Act | Deduction of rehabilitation fees for dependent handicapped relative | ₹75,000 for disability ranging from 40% to 80%, and ₹25,000 for more than 80% disability |

| 80DDB of the Income Tax Act | Deduction of medical expenditure on self or dependent relative | ₹40,000 and ₹1,00,000 for senior citizens |

| 80E of the Income Tax Act | Deduction of interest on education loan aimed at higher studies | No maximum limit, but deduction is allowed up to 8 years since the first payment of interest |

| 80EE of the Income Tax Act | Deduction of interest on home loan for first-time homeowners | ₹50,000 |

| 80G of the Income Tax Act | Deduction of donation for social causes or charity | 10% of the deduction made |

| 80GG of the Income Tax Act | Deduction of paid house rent, when HRA is not received | ₹60,000 |

| 80GGB of the Income Tax Act | Deduction of contribution to political parties | NIL |

| 80RRB of the Income Tax Act | Deduction of income from the royalty of patent | ₹3,00,000 |

| 80TTA of the Income Tax Act | Deduction of interest income from a savings bank account | ₹10,000 |

| 80U of the Income Tax Act | Deduction of tax for physically challenged individual | ₹1,00,000 and ₹1,25,000 for severe disability |

What is a TDS Certificate?

The TDS Certificate is the proof of deduction of tax at source that is issued by the employer on behalf of the employees. It is mandatory to issues these certificates to tax-paying employees.

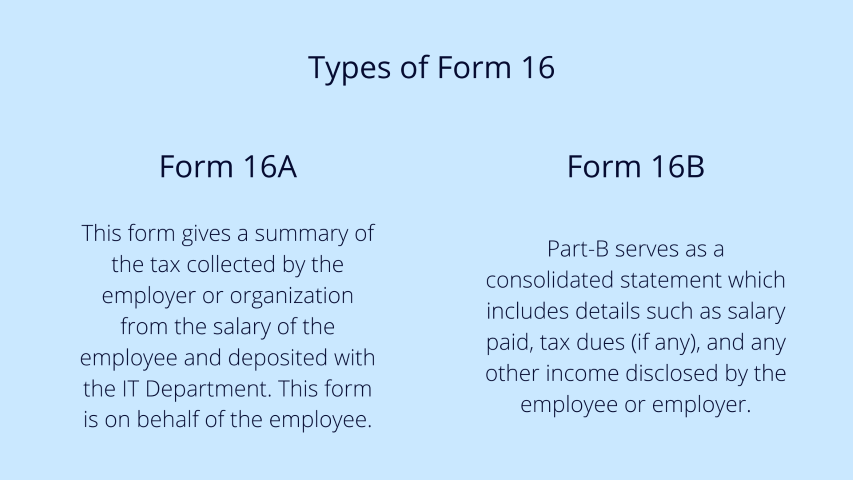

There are two types of TDS Certificates – Form 16 and Form 16A. Under Section 203 of the Income Tax Act, 1961, a certificate shall be provided to the deductee showing the amount that has been deducted as tax.

For salaried class:

In this case, Form 16 is provided by their employers, mentioning the amount deducted as TDS. Form 16 contains details such as the tax computation amount, deduction of tax, and TDS payment. Before May 31 of the following financial year, the employers must issue this form to their employees.

For non-salaried class:

In this case, Form 16A is provided by the deductor to the deductee and contains details such as tax computation, deduction of TDS, and payments made.

What is Income Tax in India?

Income tax is the tax levied on the annual income earned by an individual. The tax amount must be paid, depending on how much money you have earned over the financial year. Taxpayers can make the income tax payment online for TDS/TCS payment and Non- TDS/TCS payment. All relevant details must be filled in to make the payment. The online payment is simple and can be quickly completed.

Income Tax Rates & Slabs for FY 2020-21 & FY 2021-22 under New Tax Regime

|

Income Tax Slab |

Tax Rate |

| Up to ₹2,50,000 | NIL |

| ₹2,50,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹7,50,000 | 10% |

| ₹7,50,001 to ₹10,00,000 | 15% |

| ₹10,00,001 to ₹12,50,000 | 20% |

| ₹12,50,001 to ₹15,00,000 | 25% |

| Above ₹15,00,000 | 30% |

What is Form 16?

Forms 16 needs to be filled and submitted as a Tax Deduction at Source (TDS) proof, and has been deducted by the employer which is deposited with the Income Tax Department.

What are the Types of Form 16?

The two types of Form 16 are:

Different Sections of Form 16

Below mentioned are two different sections of Form 16:

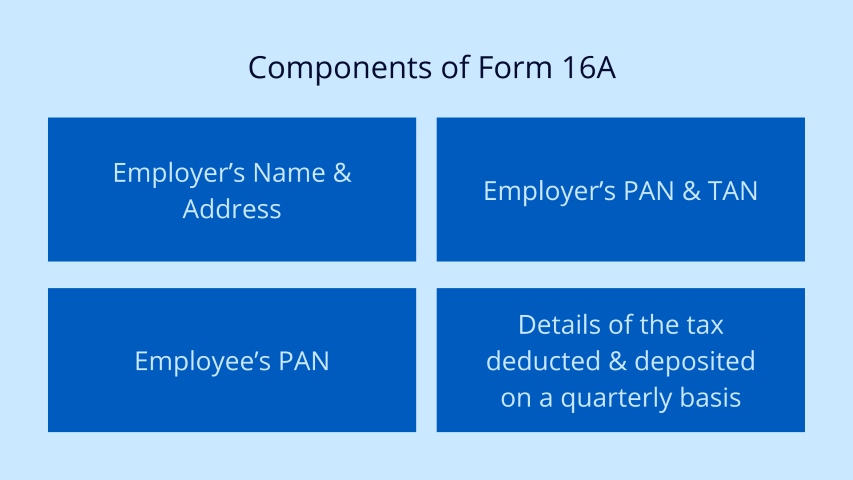

Part A

The employer must provide authentication before the certificate can be provided. Form 16 must be provided by the employer in case you move to a new job. Each new employee is provided with Form 16. Following are the main components of Form 16:

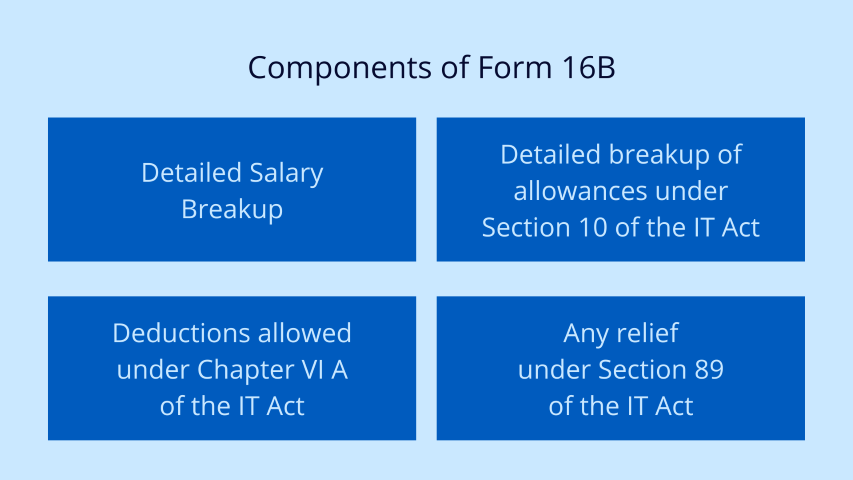

Part B

Part B has the below-mentioned components to the annexure to the first part of Form 16:

Difference Between Form 16, Form 16A, and Form 16B

| Form 16 | Form 16A |

Form 16B |

| Issued by the employer who deducts the TDS | Issued by the financial institution which deducts the TDS | Issued by the buyer to seller for deduction of TDS for sale of immovable property |

| Issued for tax deducted at source on salary | Issued for tax deducted at source for any other income except salary | Issued for tax deducted at source for the sale of immovable property |

Conclusion

We hope that this informative blog has cleared your doubts regarding TDS and Form 16.

For viewing more step-by-step guides on Pocket HRMS, click here.