The salary slip is one of the most important documents for an employee. Your salary slip provides an accurate classification of the earnings and deductions across various salary components, while also serving as proof of employment. It is shared with the employee every month as it informs them of their earnings and deductions for the month.

Since a salary slip contains all the information related to the employee’s salary, it is kept confidential within payroll software. It contains various information related to the employee and their employment, such as their employee ID, company name, designation, bank details, and more.

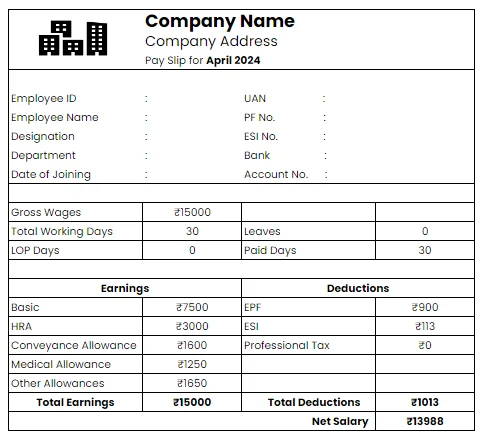

Hence, let us check out the salary slip format with the help of a few templates and understand the various components of a salary slip.

What is Salary Slip?

The salary slip is a document shared by the employer to their employees informing them of the amount they will be receiving for a specific salary cycle.

Hence, a salary slip is shared with employees every salary cycle, which provides them with the exact amount they will be receiving in the form of earnings and deductions, including the statutory and other deductions. Modern organizations have automated the process of sharing payslips by letting their HRMS or payroll systems share the soft copies using the ESS portal, mobile app or via emails.

Salary Slip Format

The salary slip format includes multiple company details like company logo, name, employee details, payment period, salary components, etc. It provides a clear understanding of each component of the employee’s salary to ensure complete understanding.

Download Different Salary Slip Formats

We have provided a basic salary slip format for your reference here; feel free to download and edit it according to your needs. We have also provided the salary slip formats in Microsoft Excel (.XLSX), Microsoft Word (.DOCX), and Portable Document Format (.PDF):

Download Simple Salary Slip Format in Excel

Download Simple Salary Slip Format in PDF

Download Simple Salary Slip Format in Word

Components of Salary Slip

Since salary slips are essential for employees and employers, it is essential to understand the salary slip format and the various components of salary slips. Having a clear understanding of these components in a payslip will help in consulting with the HR teams to tweak it for maximum tax savings as well as planning for investments.

Hence, let us understand these components in a payslip better:

1. Earnings

Earnings are the components that you receive in your compensation. They include:

➔ Basic Salary

Basic salary is the most important component of the salary since the other components are calculated as a percentage of it. Hence, it is usually 35% to 50% of the overall salary, with companies varying their percentage based on various factors. The basic salary is often relatively higher in junior positions, with allowances becoming more significant as the employee gets promoted.

➔ Dearness Allowance (DA)

Dearness Allowance is the component of the salary used to deflect the effects of inflation on the employees’ lives. Hence, it is usually 30 to 40 per cent of the basic pay. Since it is based on the cost of living at different locations, a company may provide different DA to similarly designated employees with similar work experience, living in different geographical locations.

➔ House Rent Allowance

The house rent allowance is provided to employees living in rented homes. For metro cities in India, the HRA is defined to be 50% of the basic pay, while it is 40% of the basic pay for other cities. Employees can claim tax exemption on the HRA, up to a certain limit, provided they can declare their rent agreement details.

➔ Leave Travel Allowance (LTA)

Leave Travel Allowance is provided to the employee to help them undertake leisure trips. Hence, it is meant to promote family time and a healthy work-life balance. LTA covers the travel expenses of the employee’s immediate family members as well. However, tax exemption on LTA is allowed only for 2 journeys undertaken over 4 years.

➔ Conveyance Allowance

The conveyance allowance is provided to the employees to help with their daily commute to the office. It is exempt from income tax either up to ₹ 1600 per month or the actual conveyance allowance received by the employee. Hence, it helps the employee manage their daily commuting effectively.

➔ Medical Allowance

Medical allowance is the amount paid to an employee to cover their medical expenses. Hence, the medical allowance is exempted from income tax – up to ₹ 15000 per annum – only if they submit the medical expense proofs. The medical allowance encourages the employer to take care of employee well-being and ensure a safe workplace for their staff.

➔ Other Allowances

Apart from the allowances discussed above, employers may choose to provide their staff with additional allowances. These include overtime allowances, special allowances, performance allowances, and more. It is completely taxable and hence, employers provided a bifurcation of the same in the salary slips.

➔ Bonuses

Bonuses have been a part of the employee salary structure since the introduction of statutory bonuses. An employer can also pay ex gratia payment as a bonus to their employee for excellent performance. In both cases, these details should be included in the salary slip since it is a part of the employee’s earnings for the current salary cycle.

2. Deductions

Deductions are also included in salary slips to help the employee understand the various components the company has deducted from their salaries. These include:

➔ Employees Provident Fund (EPF)

The employee provident fund is a fund managed by the government for the benefit of the employee. The employee and the employer are required to pay the Employees’ Provident Fund Organization (EPFO) equal contributions an amount that is 12% of the employee’s basic salary, each salary cycle. Hence, the employee contribution for EPF is deducted from their salaries.

➔ Professional Tax (PT)

The Professional Tax (PT) is a pre-defined amount levied by the state governments on employed individuals, and hence, it is payable only within some states in India. Since it is deducted from the employee salaries, it is mentioned in the employee salary slips. Professional tax is levied on both employed individuals and businesses.

➔ Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is the amount deducted by the employer to pay towards the employee’s income tax. The employer is responsible for deducting the amount when paying the employee and depositing it with the government. Employees can reduce the deductions by investing in equity funds such as PPF, NPS, ELSS, etc.

➔ Employee State Insurance (ESI)

Employee State Insurance (ESI) scheme is a social security scheme provided by the government, that helps the employees financially whenever required. It is mostly used for financial aid during medical emergencies, making it crucial for employee well-being. The employee is required to contribute 0.75% of their basic pay, while their employer is required to pay 3.25% of the employee’s basic pay towards ESI.

➔ Gratuity

Gratuity is the amount provided to an employee for their prolonged services in an organization. It is governed by the Payment of Gratuity Act, 1972 for Indian employees. Indian employees are provided with gratuity once they complete 5 years in an organization, and in cases where they get disabled due to an accident, injury or disease.

➔ Labour Welfare Fund

The Labour Welfare Fund is a statutory deduction towards the Labour Welfare Fund, which is managed by the Labour Welfare Board of different states. Hence, the difference between the amount and frequency of deduction are also determined by the individual states. Similarly, it does not apply to all staff members since it is mainly geared towards factory workers.

Formulae in Salary Slip Format

There are various formulae used in calculating the numerous components of salary slip format. These formulae ensure accurate calculations for determining the various components of the employee salary structure.

Hence, we are sharing some of the most relevant formulae in salary slip format:

- Cost To Company (CTC) = Gross Salary + Employee Provident Fund (EPF) + Gratuity

- Gross Salary = Basic Salary + House Rent Allowance (HRA) + Other Allowances

- Net Salary = Basic Salary + House Rent Allowance (HRA) + Dearness Allowance (DA) + Other Allowances – Income Tax (IT) – Professional Tax (PT) – Employee Provident Fund (EPF).

Importance of Salary Slips

According to the recent figures from Statista, India had over 470 million employed individuals in the year 2021. The salary slip is vital for all these employees and the employer, as it helps them understand the exact breakdown of the salary being paid. It helps the employee understand the various components of their salary such as the basic salary, gross salary, various allowances, bonuses and incentives, and more.

However, it has other relevance apart from its primary intent, such as:

1. Precise Salary Understanding

Salary slips usually have a tabular or another pictorial display of the various salary components, which inform the employee of the various components of their salary and the exact amount they will be receiving for a specific salary cycle. By understanding their salary structure better, employees can optimize their expenses to stay within budget, while also cultivating healthier investing and saving habits.

It helps them understand their Basic Pay, Dearness Allowance (DA), Special Allowance, additional bonuses, income tax, gross salary, and more, which helps them plan their expenses. It also provides information on various deductions such as Employee Provident Fund (EPF), Professional Tax (PT), etc. which helps them understand their salary structure better. It also provides information on overtime pay, which would be calculated based on the data provided by the timesheet management software.

2. Employment Proof

A salary slip is proof of the amount an employee is entitled to by the company that has employed them for the duration mentioned in the salary slip. Hence, it acts as proof that the employee worked in the company, which can be useful in cases where the employee has misplaced their relieving letter.

Due to its official credibility, salary slips are considered in various official contexts such as attesting your employment status while applying for visas, or university admissions. It can also be useful in clearing background verifications in organizations.

Your salary slip can also be used to procure salary certificates, which are usually required in certain academic organizations, especially when choosing scholarship opportunities. Similarly, since they act as proof of income, your salary slip can also be used for setting alimony amounts.

3. Income Tax Planning

Salary slips also serve the essential purpose of helping employees plan their Income Tax (IT) and other statutory obligations. Since it breaks down the salary into its components, employees can plan their tax liabilities to be minimal.

Empowered with the knowledge of the individual factors that affect their taxes, they can maximize the benefits they receive from rebates, allowances, and more. Such effective planning strategies help optimize employee savings and investments using the gross salary, by ensuring maximum tax savings.

Salary slip is a crucial tool in calculating the TDS returns as it provides the exact amount paid in taxes for a financial year. Hence, employees should keep track of their taxes and plan their finances considering the various components of their salary; and the most accessible option to check these details is within the salary slips, making them essential for ITR planning.

4. Credit Management

Salary slips also help in managing various credits since they act as income proof. When applying for various credit schemes such as loans and credit cards, the institutions providing these schemes often require income proof, which can be fulfilled with a salary slip or salary certificate.

Salary slips are not only instruments of proof of income but also act as evidence for stable income, which is relevant for financial institutions providing credit schemes to their clientele. Salary slips assure them that the individual can repay their financial obligations on time, which also improves their chances of receiving credit.

5. Salary Negotiations

Armed with the knowledge of the numerous salary components, an employee can also negotiate their salaries effectively while being interviewed. Past salary slips can be instrumental in salary negotiations with future employers since they prove the worth of the employee.

Additionally, it also helps the employers understand the value the employee brings to the table while evaluating their performance in the interview. Similarly, it lends credibility to the employee’s career claims. Moreover, salary slips enable the employee to make the necessary changes to save taxes or increase the take-home salary percentage, which can be crucial for the employee.

Also Read:

6. Government Subsidies

A salary slip also determines your income slab, which helps in securing various government subsidies and schemes for the employee and their family. For example, your ration card’s categorization is dependent on your income and to prove your income slab, you are required to submit the salary slips.

The salary slip can also be instrumental in securing loans from the government with subsidized rates of interest for essentials like securing a home or setting up a business. Additionally, it can also provide access to various State and Central Government schemes, which provide you with discounted or free services such as medical care, food, public transport, etc.

Conclusion

A salary slip is a document which is crucial for the employee and the employer as it provides robust proof of employment by the employer. Also known as a pay slip, it also helps the employee understand the various components of their salaries, helping them plan their taxes. It also helps with requesting credit such as loans and government subsidies.

Hence, it is essential to have a good idea of salary slips and its format to understand its various components. That is why we have shared handy salary slip format templates in multiple file formats, which will help you quickly edit and tweak them to your requirements. Feel free to edit it by adding your company details and make it your standard salary slip format.