How Payroll Software simplifies Payroll for New Businesses?

Table of Contents

Reading Time: 7 minutes

For a growing business, salary processing is one of the major headaches because of its complexity. It is especially stressful for startups since a single HR professional usually handles payroll processing in these companies. This HR would already be under the stress of finding and recruiting the right employees, handling compliance, and developing HR policies for the organization, and payroll processing becomes an additional burden for them.

Growing businesses often do not have the time and resources to ensure on-time, accurate payments to their staff members, which could lead to their dissatisfaction. So, what is the alternative? Should you opt for payroll software? How Payroll Software simplifies Payroll for New Businesses? Let us check out.

Challenges with Manual Payroll Processing

Manual payroll processing can derail an organization’s employee management strategies, as payroll is one of the most critical factors in safeguarding employee loyalty and satisfaction. Due to the complexities of payroll management and the amount of time required to undertake the process, it becomes hectic for a single individual to process employee payroll, which is often the case in startups and growing businesses.

The following are some of the major challenges with manual payroll processing:

1. Error Prone

Human errors can creep into the payroll calculations when it is undertaken manually as these calculations require data from different systems engaging with employee management, such as attendance management, expense management, performance management, etc. Additionally, since various salary components are dependent on the basic salary, a single error can wreak havoc in payroll calculations, resulting in inaccurate payments, leading to frustrated employees.

2. Time-consuming

Manual payroll calculations are also highly time-consuming due to their complexity and the different monthly inputs required. To calculate employee salaries manually, HRs are required to gather these inputs and arrive at the final basic salary for a specific salary cycle, and calculate the other components in the salary based on it. Additionally, they should also deduct the taxes and generate payroll reports, ensuring that everything is undertaken in compliance with the regulatory requirements. The numerous calculations, combined with cross-verifications, require a lot of time and resources, making payroll processing one of the most stressful HR activities.

3. Security Concerns

When payroll processing is undertaken manually, the details are usually recorded on physical ledgers or digital spreadsheets, both of which hardly provide any data security features. Since the payroll data consists of sensitive employee records such as their salary structure, tax details, bank information, etc., adequate restrictions are required to avoid being accessed and even manipulated by unauthorized personnel.

4. Compliance Risks

Another major challenge is the ever-changing statutory rules and regulations. These regulatory compliances are a major headache for HR as they are required to stay up to date with these norms and calculate employee salaries according to them. Failure to comply with even a single rule could result in hefty fines, which can prove disastrous for startups and growing businesses, making salary processing a high-risk endeavour for these organizations.

5. Scalability Issues

When an organization is growing, the number of employees and departments starts scaling along with its processes and revenue. Payroll processing should also scale according to company growth to keep up with the added complexities resulting from it. However, it will not be easy to scale manual payroll processing as quickly as the growth, making payroll systems a must-have requirement for these businesses.

6. Limited Reporting

Companies are required to furnish detailed payroll reports to the government. However, with manual payroll processing, generating these reports becomes another time-consuming task which takes a lot of time. Given that such report submissions are required to be undertaken within a limited timeframe, HRs in growing businesses often find themselves all over the place, trying to complete these reports on time.

7. Employee Disputes

Manual payroll processing is hectic when everything goes according to plan. However, it gets even more challenging when errors creep into the system and employees start complaining about incorrect salary disbursals. Whenever an employee raises a dispute with their salary, their HR needs to rectify or provide clarification about it as soon as possible, as deferred complaints and salaries often lead to employees walking out of the organization.

8. Lack of Transparency

Another major challenge for HRs in growing organizations is to provide good transparency to employees about their payroll. Startups struggle to provide even pay slips when payroll is undertaken manually. The lack of transparency can lead to complications down the line, especially in cases where employees receive incorrect salaries due to error-prone calculations.

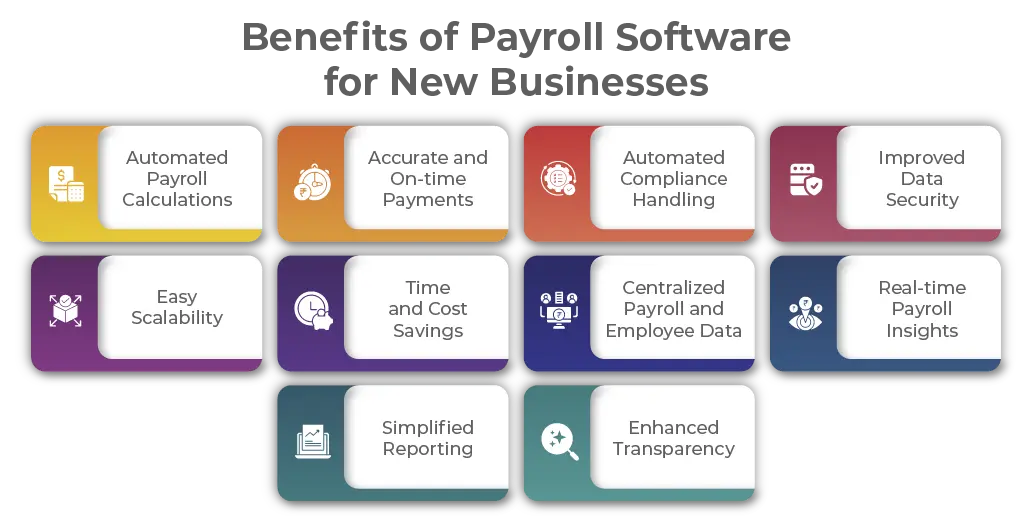

Benefits of Payroll Software for New Businesses

All of the challenges discussed above can be easily resolved by deploying a dedicated payroll system. Since most payroll systems are implemented on the cloud-computing platform, it becomes very easy for growing businesses to transfer their data and start payroll processing online.

Some of the other major benefits of deploying payroll management system for growing businesses are:

➔ Automated Payroll Calculations

By automating the entire payroll calculation, these systems provide multiple benefits to the organization. It helps avoid irregular and inaccurate salaries, helping restore employee trust. It saves HR’s productive hours spent on manual calculations, which required them to cross-verify each monthly input to ensure accuracy. The time saved can also be allocated to other strategic HR tasks, helping them grow their company.

➔ Accurate and On-time Payments

With automated payroll calculations, HRs can ensure that their employees receive accurate salaries on time. A dedicated payroll system takes care of salary computations by staying up to date with the latest statutory rules and regulations, and making the necessary adjustments. By completely avoiding manual intervention in the payroll calculation process, payroll management system streamlines payroll calculations, making it quick and easy for HR teams.

➔ Automated Compliance Handling

Since modern payroll system is deployed on the cloud, it can be instantly updated with the latest changes in the statutory rules and regulations without any downtime. Having this kind of flexibility helps these systems remain updated with the latest changes, helping you offload your compliance handling duties to the system.

➔ Improved Data Security

Online payroll software also offers enhanced data security, thanks to encrypted information storage, which uses enterprise-grade encryption algorithms to secure the data during storage and access. Additionally, these systems also provide secure user access control that safeguards the employee and payroll data from unauthorized access. Modern payroll systems even allocate roles to the users, ensuring that only the required data is visible to them, further enhancing data security.

➔ Easy Scalability

Since the latest payroll system is deployed using cloud infrastructure, it can easily scale according to the changing requirements of growing organizations. As a result, companies can easily add or remove modules based on their needs. It is especially useful for smaller businesses as they may not require all of the advanced features. It also proves to be economical for these organizations, as they need to change their software vendor as they start requiring additional modules.

➔ Time and Cost Savings

Manual payroll processing is time-consuming, which is a major issue for growing organizations, as they usually have a single HR manager managing their employees. With a robust payroll solution, these organizations can save their HR’s productive hours, as well as save the money spent on fines or penalties due to compliance oversights. It helps HR reallocate their time for strategic tasks, which ultimately helps improve employee productivity and engagement.

➔ Centralized Payroll and Employee Data

Another major benefit of a payroll system is that the employee and payroll data will be centralized, providing HR with easy and secure access to all information within a single interface. With manual systems, the HR would have to go through multiple ledgers or spreadsheets to access the same information, which is both time-consuming and impractical, given the huge amount of data generated within organizations.

➔ Real-time Payroll Insights

Similarly, as the payroll system has a central data repository of employee and payroll data, it can quickly provide insights into your overall payroll processing, helping you identify opportunities to cut down costs, as well as improve efficiency. Having access to this data enables growing companies to further streamline their payroll operations to ensure minimal time and costs, resulting in better profits.

➔ Simplified Reporting

Similarly, payroll software provides simplified options for statutory reporting. Along with handy report templates, these payroll systems also provide HRs with the option to generate custom reports that provide insights into payroll data. Such insights help in making data-backed decisions related to employee payroll, as well as helping improve the overall efficiency of the payroll process.

➔ Enhanced Transparency

Payroll software also helps increase the employees’ trust in their organization with the help of intuitive Employee Self-Service or ESS portals and user-friendly mobile apps. It provides much-needed transparency for the employee as they will be able to access their payslips and view their salary and tax information right from their fingertips.

Also Read:

Key Factors to Consider While Choosing a Payroll Software

If you are a growing business looking for the perfect payroll solution, here are a few things to keep in mind:

- Figure out the exact features that you wish to have in the ideal system.

- Search for a cloud-based system with a secure database.

- Check the different support options provided by the software service provider.

- Enquire whether they can customize their system according to your company’s policies.

- Check whether it is scalable and whether you can add or remove features based on the company’s needs.

- Understand the integration capabilities of the software and whether they support your existing software.

- Check for their unique features, as every payroll company will advertise its USP.

For example, Pocket HRMS provides smHRt® Payroll, a first-of-its-kind Machine Learning-based payroll engine that learns your payroll data and highlights any errors for you, which helps you rectify any errors in the data before processing your payroll. Such technologically advanced features enable Pocket HRMS to be India’s number one Payroll software.

Conclusion

So, that is how payroll software simplifies salary processing for growing businesses. While payroll software might seem like an additional cost for your growing business, the benefits it offers offset the extra cost, making it a must-have system in your organization.

You should check out the different systems available in the market and find the ideal one based on your requirements. If you are interested in Pocket HRMS, feel free to contact us by sharing your details here. We can connect for a completely free demo, which will help you understand whether Pocket HRMS is the ideal payroll software for your business.