What is Universal Account Number / UAN Number? – (Detailed Guide)

Table of Contents

Reading Time: 6 minutes

The term ‘UAN Number’ is used whenever an employee’s provident fund (PF) is discussed. You can undertake different essential PF-related tasks only if you have activated your UAN Number.

With the digitalization of Government processes, the Employee Provident Fund Organisation (EPFO) has made it mandatory for all working employees to activate the UAN Number and use it to avail of any services related to their PF account.

Since the PF account is crucial for all employees, it is essential for them to generate their UAN or procure it from their company and activate UAN before using it.

In this article, we will check out the multiple advantages and benefits of having a UAN Number as well as understand its relevance for a PF account holder. We will also discuss the steps to transfer the accounts as well as check out the various other services offered on the EPFO portal.

Also Read: How to claim PF Online? Step-by-Step Guide

What is Universal Account Number (UAN) Number?

The Universal Account Number (UAN) is a unique identification number provided to every employee who is a member of the Employee’s Provident Fund. The Ministry of Labour and Employment issues this number. The Employee’s Provident Fund Organisation (EPFO) allocates this 12-digit number to each employee to access and manage their PF account online.

The UAN is unique for each employee and stays constant throughout their career, irrespective of the number of jobs and positions they have held. Each time an employee changes their job, a unique ‘Member Identification Number’ or ‘Member ID’ is allocated to the employee, linked with their UAN. When an employee changes jobs, they can request the EPFO to assign a new member ID directly or provide their existing UAN to their employer and ask them to request it with the EPFO.

Earlier, a different PF account used to be created every time an employee changes their company. However, keeping track of the employee’s PF details was troublesome as one had to track their job switches to get a good idea of their PF contributions. The Universal Account Number made this process simpler by collating an employee’s PF data under one roof.

The Relevance of UAN Number

The UAN is essential for the employee, the employer, and the EPFO to track an employee’s PF contributions. It also helps the EPFO in tracking the job changes of an employee. For the employee, the UAN ensures they can transfer their PF from Member ID to another account and withdraw their PF whenever required.

One simply needs to link their new PF Number Member ID with their existing UAN, which their employer would do, on their behalf. The Universal Account Number also helps the EPFO to ensure that all the PF accounts are genuine. The employer can also authenticate the employee through their UAN if their KYC documents are verified.

Additionally, the employer will not be able to hold the employee’s PF contribution, as their PF details are visible to the employee online with the help of their UAN. Employees can even activate monthly PF deposit SMS if they wish to keep track of their PF account balance automatically.

What are the Advantages of Having a UAN Number?

There are many advantages of having a UAN. Some of the significant benefits are:

➔ Lesser Employer Involvement

With the help of UAN, the employee can transfer their PF from one account to another without explicit consent from their employer. They would require only their KYC to be completed, which can be done beforehand.

➔ Avoid Manual Fund Transfer

If the employee provides their KYC documents and their UAN to their new employer, their existing funds can be transferred to their new PF account without any manual input by the employee.

➔ Get SMS Alerts

Employees can receive SMS alerts whenever any changes happen to their PF account. There are no charges for this service.

➔ Access to Unified EPFO Portal

Using UAN, the employee can log in to their EPFO account online to view their account balance, edit their details, complete their KYC, transfer their funds, or withdraw them.

➔ Access to a Unified Passbook

The UAN can also access the Member Passbook portal, which provides the details of the different PF accounts under one roof.

➔ View PF History

The employers can view the employee’s PF history and get a vague idea of their previous employment.

Also Read: All You Need to Know about Labour Welfare Fund

How to Generate Your UAN Number?

Your employer generally generates a Universal Account Number by using your details and entering it into the EPFO’s system when they process your payroll for the 1st time. However, you can get to know your UAN by visiting the Employee EPF Portal.

Follow the steps provided below to get your UAN:

- Once you visit the EPFO members portal, click on the ‘Know your UAN’ option.

- Enter your mobile number, verify the captcha, and click on ‘Request OTP’ to get an OTP on the number you entered.

- On the next page, enter your name, date of birth, PAN/Aadhaar/Member ID number, and verify the captcha. Click on the ‘Show my UAN’ button to proceed.

- You will get an authorization PIN on your mobile number. Enter that number and click on the ‘Validate OTP and get UAN’ button to proceed further.

- You will receive your UAN on your mobile number.

How to Activate your UAN Number online?

Once your UAN is generated successfully, you need to activate it to start using it. Activating the UAN also gives you access to the member portal, using which you can manage your PF account.

Hence, let us understand the steps for activating the Universal Account Number:

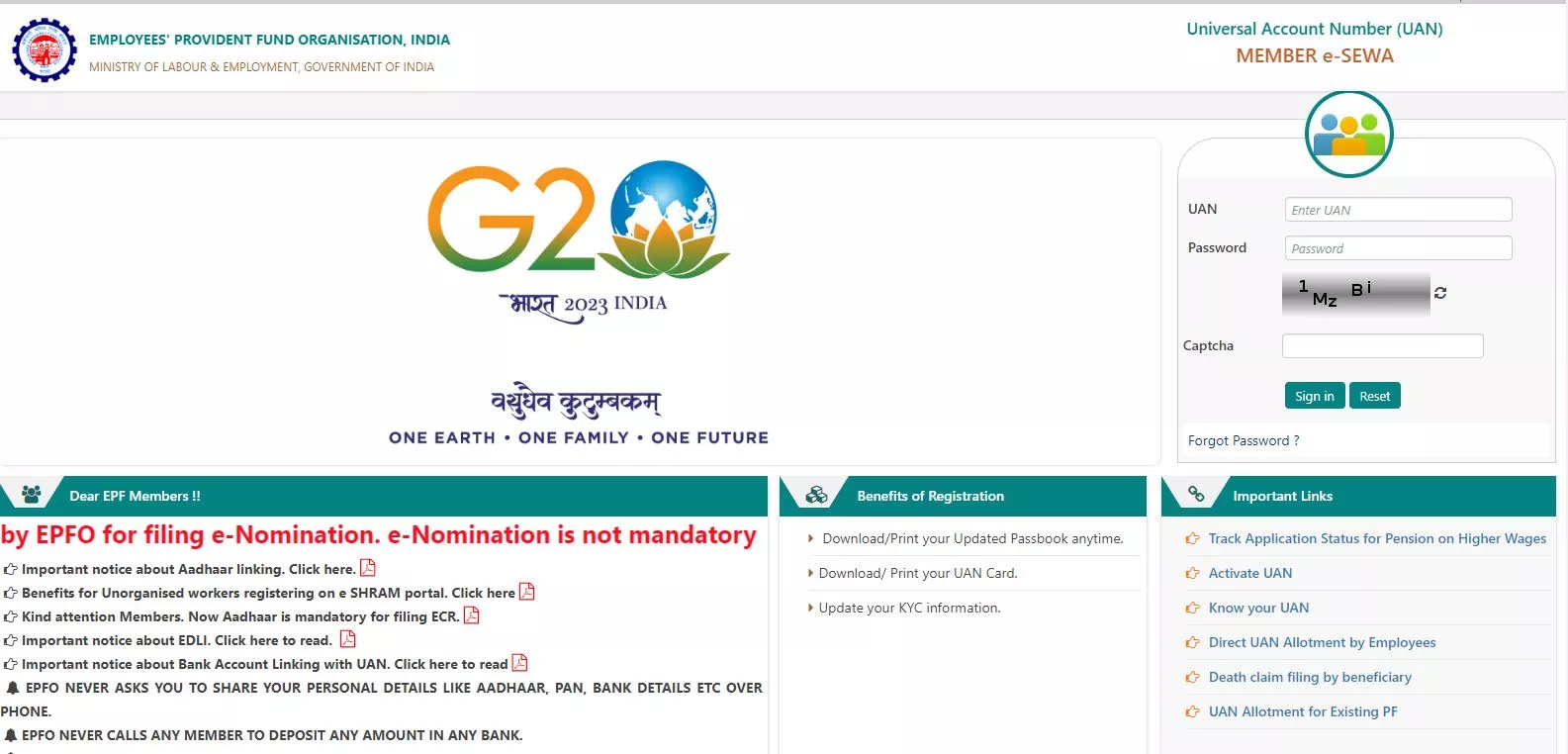

- Visit the EPFO Member Portal.

- Click on the ‘Activate UAN’ link.

- Enter your UAN or Member ID or Aadhaar Number or PAN Number. Enter your name, date of birth, mobile number, and email ID. You will have to verify the captcha again.

- Click on the ‘Get Authentication PIN’ button. You will get an authorization PIN on your registered mobile number.

- Check the ‘I agree’ option and click on ‘Validate OTP and Activate UAN’ button; to activate your UAN.

What to do in case you forget the UAN Portal Password?

The EPFO portal has the option to reset your EPF account password if you forget it.

For resetting it, please follow the steps mentioned below:

- Visit the EPFO Member Portal.

- Click on the ‘Forgot Password’ option.

- Enter your Universal Account Number and verify the captcha code.

- Enter your name, date of birth, and gender and click on the ‘Verify’ button.

- You will receive an OTP on your registered mobile number.

- Enter the OTP and click on the ‘Submit’ button.

Once your password is reset, you can log in to your EPFO account using your UAN and the new password to manage your account.

How to Link your Aadhaar with your UAN Number?

Linking your Aadhaar Card Number with your UAN provides you with easier KYC when required. It also helps expedite the PF withdrawal and fund transfer process.

We have provided the steps to link your Aadhaar Card Number with your UAN below:

- Log in to the UAN portal for the employees by entering your UAN, password and verifying the captcha.

- Click on the ‘Manage’ menu and select the ‘KYC’ option.

- Select the ‘Aadhaar’ option and enter your Aadhaar Card Number and full name as per the Aadhaar Card in the space provided.

- Click on the ‘Submit’ button to save the data, after entering the OTP received on your registered mobile number.

- Your details will be visible under the ‘Pending KYC’ tab. Once your employer approves it, you can see it under the ‘Approved KYC’ tab. It should take about 15 days for its approval.

What Documents are required for Generating UAN Number?

Since the EPFO generates a Universal Account Number, you need to submit various documents to ensure the accuracy of the process.

The following are the documents required for UAN generation:

1. PAN Card

The PAN Card should already be linked with your UAN.

2. Aadhaar Card

Since your Aadhaar Card is linked to your mobile number, it is mandatory.

3. Bank Account Details

Account details such as the account number, IFSC code, and branch name.

4. Address Proof

Government-recognized address proof such as a recent utility bill, house lease agreement, ration card, etc.

5. Government-recognized ID Proof

Government-recognized ID proof such as driver’s license, passport, Voter ID, SSLC, etc.

6. ESIC Card

ESIC Card can be provided if you already have one in your possession.

What are the Services offered by the UAN Portal?

The EPFO portal acts as a one-stop solution to manage your PF accounts. Using your Universal Account Number as the login ID ensures that you can view the details of all your PF accounts in a single location and manage them effectively. The employees can also view and download their PF passbooks using this portal. At the same time, the employer can analyze their employment history.

The significant features of this portal include:

- Updating the KYC documents and checking their KYC status

- Viewing the different PF Number Member IDs and their status

- Changing one’s details to reflect accurate data

- Viewing and downloading the PF passbook

- Filing claims and viewing their status.

Conclusion

The Universal Account Number makes it easy for the employees, the employer, and the EPFO to view and manage the PF account. It collates the multiple PF accounts defined by multiple PF Number Member IDs under a single account to ensure that the PF details of each employee can be tracked effectively. It ensures that the functions related to the PF account, such as contributing to it, claiming it, etc., are undertaken swiftly.