Payroll Software

Payroll Software with Machine Learning for Accurate Payroll

Ensure accurate, on-time compliant salaries for your employees with a Dedicated Maker-Checker and smHRt® Payroll powered by Machine Learning.

Trusted by Leading Brands Using Our Payroll Software

Overview of the Payroll Management System

Payroll Software is a platform that enables companies to calculate salaries automatically and pay them on time. It automates all aspects of payroll management, such as calculating payroll by capturing monthly inputs and ensuring compliance with the statutory regulations, as well as ensuring secure storage of the company’s payroll database. It helps organizations maintain payroll records accurately and improve the efficiency of payroll processing, and related factors such as FnF Settlement, expense reimbursements, etc.

Key Benefits of Payroll Software in India for Modern Businesses

Here are the top 4 benefits of payroll software that boost accuracy, ensure compliance, save time, and build employee trust.

Enhanced

Efficiency

The system delivers end-to-end automation for salary calculations, attendance syncing, tax deductions, and compliance updates. With our HRMS software, the company reduces manual work, minimizes errors, speeds up monthly payroll cycles, and streamlines approvals.

Errorless

Calculations

Payroll system invites the power of automation and initiates accuracy in salary computation, tax deductions, arrears, overtime, PF, ESI,etc. The errorless calculation delivers built-in validations, alerts, and audit trails to ensure accuracy and consistency across payroll.

Robust

Security

The software provides robust data security to protect sensitive information, including employee performance, attendance data, payroll-related information, and bank account details. The system prevents data breaches and protects businesses from illegal access.

Automated

Compliance

The Payroll software comes with end-to-end AI assistance, helping companies stay advanced with the latest compliance updates and auto-sync with statutory company rules. Besides, the system assures continuous accuracy and legal risk in payroll.

smHRt Features for Accurate Payroll Processing

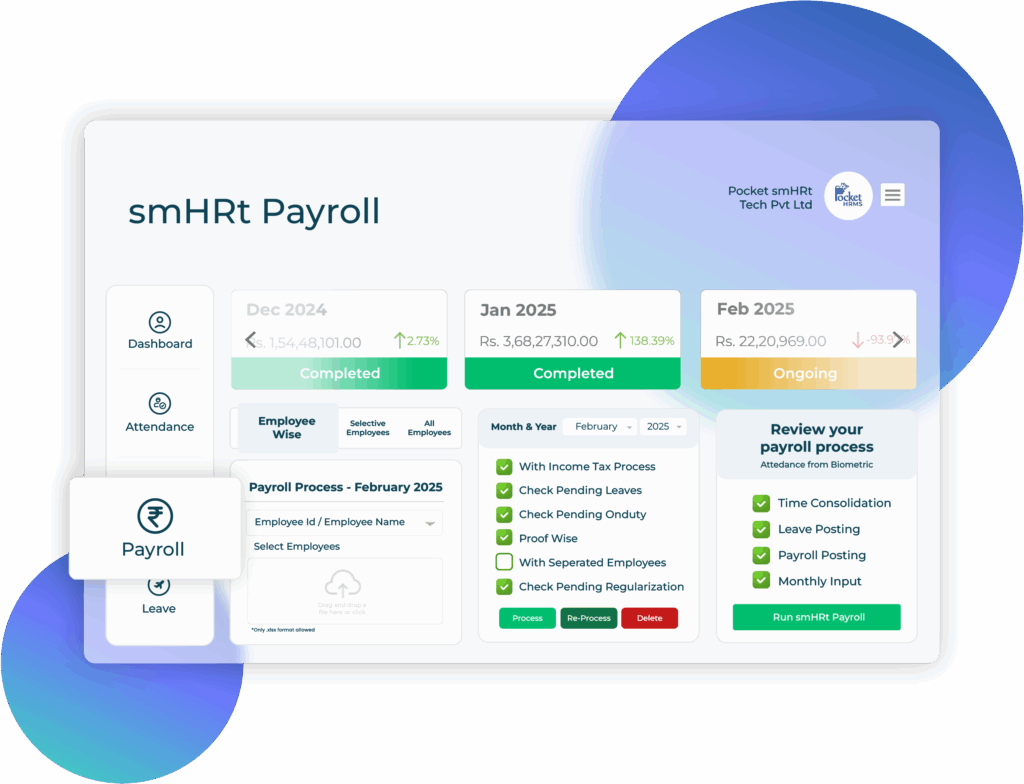

Payroll Processing just got SmHRter!

Simplify your entire payroll process with smHRt® Payroll, saving your time and effort.

- Machine Learning-based Payroll Processing

- Advanced Pre-Process Checks

- Support for Multiple Salary Structures

- Dedicated Formula Builder

- Automated Statutory Deductions

- Intuitive Payslip Designer

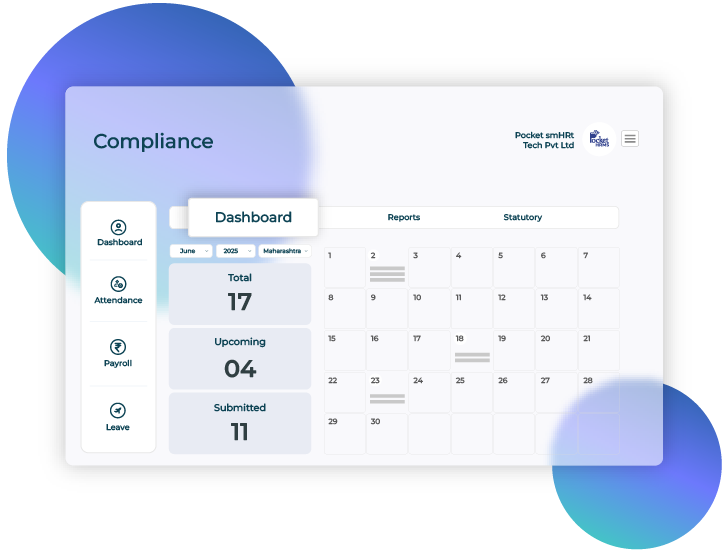

Peace of Mind Starts with Automated Compliance

Let us take care of your compliance with the statutory regulations for a stress-free experience.

- smHRt Compliance Dashboard

- All-inclusive IT Declarations

- Seamless Year-end Transfers

- Dedicated Tax Calculator

- eTDS & Form 16 Generation

On-time Salary Payments, every time!

Seems too good to be true? Well, it is possible with our advanced Next-Gen Payroll System!

- Multi-tier salary processing

- Integrated with Biometric Attendance

- User-defined Salary Heads

- Easy Arrears Calculations

- Loan & Salary Advance Integration

24/7 Remote Access with ESS Portal

Let your employees stay engaged with a user-friendly mobile app & an intuitive web-based ESS portal.

- Simplified Attendance Tracking

- One-click Payslip Downloads

- Facial recognition-based Attendance

- Expense Claims Submission

- Dedicated Help Desk

- Leave & Holiday Calendar

Make Data work for you with In-depth Analytics

Get enhanced insights into your workforce with highly customizable reports and interactive dashboards.

- Dashboard with Interactive Widgets

- Data Wizard for custom Reports generation

- MIS & Template-based Reporting

- Real-time Console with Visual Data

Explore More HR Solutions That Work With Our Payroll Software

A suite of robust HR solutions is designed to integrate seamlessly with the payroll system. From attendance and leave management to performance and compliance tools, the systems work together to simplify HR operations, improve accuracy, all from a single, connected platform.

HR

Management Software

An HRMS software offers a comprehensive employee management solution that streamlines HR operations, enhances efficiency, and ensures consistency across all HR functions.

Performance Management System

A performance management system with brilliant features like smHRt KPI, 360-degree appraisal, OKR, and AI performance insights ensures transparency and supports fair payroll initiation.

Attendance Management System

An attendance management system with advanced features helps in work-hour tracking, late mark detection, overtime calculation, and seamless integration with payroll processing.

Leave

Management

System

A leave management system with multi-type leave options helps employees mark their leave anytime, anywhere & assists the employers with leave detection, analysis and payroll processing.

How does Payroll Software work?

Payroll software is the one-stop solution for simplifying the employees’ payroll process. The system automates preliminary activities such as employee performance analysis, leave and attendance data collection, and then evaluates salaries and makes final approvals after clarifying deductions. After that, the system processes the payment, generates payslips, and performs real-time bank transfers. Besides, the system is responsible for recording updates and generating feedback.

Here is the process by which the payroll software operates and the benefits a company receives upon integration.

Why Choose Pocket HRMS Payroll Software?

Pocket HRMS payroll software delivers high-end automation for accurate payroll calculations, salary analysis and on-time salary disbursals, ultimately creating an efficient payroll solution for growing firms.

Intelligent Error Detection

Machine Learning-based payroll processing for capturing and highlighting errors.

Advanced Formula builder

Dedicated Formula Builder with complex formulae for custom salary structures.

Up-to-date Compliance

State-wise Compliance Calendar for staying up to date with the statutory laws.

On-time Payroll Processing

Integrated payroll with auto capture of monthly inputs for streamlined payroll.

Top-Rated HR & Payroll Software in India

Pocket HRMS is a leading HRMS software solution provider, recognized by top-notch review platforms like ‘G2’ and ‘Software Suggest’ for its revolutionary features.

#1 Choice of Industry Experts

Payroll Software for Every Industry

Most Trusted Payroll Software across the Metro Cities

Pocket HRMS payroll software is spread beyond the Mumbai location. In India, companies in major cities such as Bangalore, Chennai, Hyderabad, Delhi, Jaipur, Pune, Ahmedabad, and Indore can easily integrate our payroll assistant and enjoy the power of foolproof automation with a few clicks.

FAQs on Payroll Software

What is Payroll Software?

Payroll Software is a system that helps you manage employee payroll by enabling accurate calculations and automating compliances, to enable you to disburse it accurately on time. To ensure accurate payroll, modern cloud-based payroll software like Pocket HRMS utilizes advanced technologies like Machine Learning, which sifts through the payroll data and informs the user of any discrepancies such as data outliers.

According to Mordor Intelligence, the HR payroll solution market is estimated to be at USD 1.66 billion in 2024. It is expected to reach USD 2.38 billion by 2029, by growing at a CAGR of 7.49% during the forecast tenure (2024- 2029).

Which software is best for payroll in India?

Pocket HRMS is the best payroll software in India as it provides you with the ‘smHRt Payroll’ feature, which utilizes Machine Learning to train on your payroll data and highlight any errors in it.

What is Payroll?

Payroll is the process of disbursing employees’ salaries. It begins with preparing a list of employees eligible for payment, followed by calculating salary amounts and bonuses, and concludes with recording the related expenses.

This process ensures adherence to each employee’s payroll cycle and accurately applies mandatory deductions, including PF contributions, TDS, meal coupons, and other applicable components.

What are the examples of Payroll software?

Top payroll software examples include Pocket HRMS, GreytHR, ADP, SAP SuccessFactors, Keka, Workday Payroll, and Zoho Payroll. These solutions help organisations automate salary processing, tax calculations, statutory compliance, payslip generation, and employee self-service, making payroll management more accurate and efficient across businesses of all sizes.

What are the uses of payroll software?

Payroll software is used to automate salary calculations, process employee payments on time, manage tax deductions and statutory compliance, generate payslips, and maintain payroll records. It also helps track attendance and leave data, reduce manual errors, ensure data security, and improve overall payroll management efficiency.

Which are the Top 10 payroll software in India?

Here’s a list of top payroll software in India, with Pocket HRMS placed first:

1. Pocket HRMS

India’s leading payroll & HRMS platform with automation, compliance, and cutting-edge AI features and functionalities.

2. RazorpayX Payroll

Modern payroll with automated compliance and salary disbursal.

3. GreytHR

Established payroll solution with strong statutory support.

4. Zoho Payroll

Cloud-based payroll, exclusive and excellent for the Zoho ecosystem users.

5. HROne

Robust compliance engine for complex payroll needs.

6. factoHR

User-friendly payroll and HR suite.

7. Keka HR

Intuitive payroll and attendance tracking.

8. sumHR

Flexible payroll with performance and HR features.

9. Qandle

Cloud HR platform with payroll and analytics.

10. Zimyo HRMS

All-in-one HR & payroll solution for Indian SMEs.

How does our payroll software help startup Small, Mid and Large Level businesses?

Payroll software streamlines payroll processing for any organisation. The tool not only simplifies payroll processing but also smooths any finance-related challenges employers face during analysis, disbursing, and reviewing employee salaries. Besides, the software offers secure data management, helping organisations save time, maintain compliance, and improve overall payroll efficiency.

What are the benefits for cloud based payroll software?

Cloud-based payroll software provides anytime, anywhere access, automatic updates, and easy scalability. It minimises the infrastructure costs, comes with real-time compliance with statutory regulations, enhances data security, and minimises manual errors. With seamless integrations and automated processes, it improves efficiency, accuracy, and flexibility for businesses of all sizes.

Pocket HRMS Payroll Questions, Answered

Is the data secure with Pocket HRMS Cloud Payroll Software?

Pocket HRMS is hosted on Microsoft Azure, which utilizes 256-bit enterprise-grade encryption standard to keep your payroll data safe and secure. Combined with robust uptime and architecture, Microsoft Azure has proven to be the best option to safeguard sensitive data like employee payroll information. So, yes, the data remains completely secure with our cloud payroll software.

Can I run payroll for hourly, salaried, and contract employees?

Absolutely. Being a highly flexible system, Pocket HRMS allows you to calculate payroll for hourly, salaried and contract employees, by configuring the employee types according to your company requirements.

Can employees access their payslips and tax documents online?

Yes, Pocket HRMS comes with an intuitive web-based ESS portal which provides them access to their payslips and tax documents whenever required. We also have a dedicated mobile app which provides your employees easy access to their documents.

Can I generate custom reports for audits or internal reviews?

Yes, with a highly flexible Data Wizard, you will be able to generate custom reports for audits and internal reviews. You can even save your configuration as a template, which enables you to easily generate the same report next time with fewer clicks.

Can I customize pay components like bonuses, overtime, or deductions?

Yes, Pocket HRMS is a highly flexible payroll software that enables you to customize every component of your employee salaries, including bonuses, overtime, and deductions. You can even add formulae for their calculations, making it highly efficient.

Can Pocket HRMS Payroll Software handle multiple pay schedules?

Absolutely! Pocket HRMS is an employee payroll software which is customizable to your exact payroll requirements. By configuring it to handle multiple pay schedules, you can process salaries and generate payslips whenever you require, ensuring complete flexibility. Additionally, processing your employee salaries through ‘smHRt Payroll’ ensures complete accuracy and enhanced efficiency.

How much does Pocket HRMS cost?

The Standard Plan of Pocket HRMS costs ₹2995 per month for up to 50 employees. If you employ more than 50 employees, then you can pay an additional ₹60 per employee per month to enjoy the numerous features of the Standard Plan.

Similarly, the rate for the Professional Plan of Pocket HRMS is ₹4495 per month for up to 50 employees. If you employ more than 50 employees, then you can pay an additional ₹90 per employee per month to enjoy the extra features of this Plan along with the Standard Plan features.

The most feature-rich plan of Pocket HRMS is the Premium Plan which has all the features provided in the Professional Plan along with additional exceptional features which make Pocket HRMS revolutionary software for your organization.

Explore HRMS Resources

Pocket HRMS payroll software is spread beyond the Mumbai location. In India, companies in major cities such as Bangalore, Chennai, Hyderabad, Delhi, Jaipur, Pune, Ahmedabad, and Indore can easily integrate our payroll assistant and enjoy the power of foolproof automation with a few clicks.