What is Form 12C?

Form 12C is a document used by taxpayers in India to provide details of their income to the Income Tax Department. It serves as a communication between the taxpayer and the assessing officer regarding the income sources and tax liabilities. Taxpayers typically fill out Form 12C when requested by the assessing officer as part of the tax assessment process. The form requires details such as income from salary, house property, capital gains, and other sources. It’s essential for accurate tax assessment and compliance with Indian tax laws.

Purpose of Form 12C

Form 12C is an Income Tax form used in India. Its primary purpose is to provide details of income earned by an individual from multiple sources to their employer for the purpose of deducting the correct amount of tax at source (TDS). Here’s a breakdown of the purpose of Form 12C:

1. Submission of Income Details

Individuals who have income from multiple sources, such as salaries, interest on savings, rental income, or income from other sources, need to submit details of these incomes to their employer. Form 12C serves as a medium for providing these income details.

2. Calculation of Tax Deducted at Source (TDS)

Employers use the information provided in Form 12C to calculate the total income of the employee and determine the appropriate amount of tax to be deducted at source (TDS) from their salary. TDS is deducted by the employer based on the individual’s total income and applicable tax rates.

3. Facilitating Correct Tax Deduction

By providing accurate income details through Form 12C, employees ensure that the correct amount of tax is deducted at source from their salary. This helps in avoiding under or over deduction of tax, which can lead to additional tax liabilities or refunds during the assessment process.

4. Compliance with Income Tax Regulations

Form 12C facilitates compliance with the Income Tax Act and Regulations in India by ensuring that taxes are deducted at source as per the prescribed rates and rules. It helps both employees and employers adhere to their tax obligations.

5. Assessment of Tax Liability

Form 12C assists in the assessment of an individual’s tax liability by providing a comprehensive overview of their income from various sources. This information is crucial for filing income tax returns accurately and for determining any additional tax liabilities or refunds.

Documents Required for Filling Form 12C

To fill out Form 12C in India, you typically need the following documents and information:

- Personal Information: Basic personal details such as name, PAN (Permanent Account Number), residential address, contact number, and email address.

- Income Details: Information about income earned from various sources during the financial year. This may include:

- Salary income: Details of salary received, including basic salary, allowances, bonuses, etc.

- Income from house property: Rental income received, along with details of property ownership.

- Income from other sources: Interest income from savings accounts, fixed deposits, dividends, etc.

- Any other income: Income from investments, capital gains, or business/profession.

- Investment Details: Information about investments and deductions claimed under various sections of the Income Tax Act, such as:

- Section 80C: Investments in instruments like Provident Fund (PF), Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), National Savings Certificate (NSC), etc.

- Section 80D: Premium paid for health insurance.

- Section 80E: Interest paid on education loan.

- Any other deductions claimed under different sections.

- Form 16 (TDS Certificate): Form 16 is a certificate issued by the employer to the employee showing the total salary paid and the tax deducted at source (TDS). It provides details of income, taxes deducted, and tax-saving investments made by the employee.

- Bank Statements: Bank statements for the financial year showing transactions related to income, expenses, investments, loans, etc. This helps in verifying income details and claiming deductions accurately.

- Rent Receipts (if applicable): Rent receipts for claiming House Rent Allowance (HRA) exemption under Section 10(13A) of the Income Tax Act.

- Interest Certificates: Certificates issued by banks or financial institutions showing the interest earned on savings accounts, fixed deposits, recurring deposits, etc.

- Property Details (if applicable): Details of owned properties, including address, ownership percentage, rental income received, and interest paid on housing loans.

- Form 26AS: Form 26AS is a consolidated statement showing tax credits related to your PAN. It contains details of TDS, TCS (Tax Collected at Source), advance tax, and self-assessment tax paid during the financial year.

- Any Other Relevant Documents: Depending on your specific financial situation, you may need additional documents such as receipts for donations made, certificates for tax-saving investments, details of foreign income/assets (if applicable), etc.

How to Fill Form 12C?

Form 12C is typically filled out by employees in India to provide details of their income from multiple sources to their employer. Here’s a step-by-step guide on how to fill out Form 12C:

- Download Form 12C: You can download Form 12C from the official website of the Income Tax Department of India or obtain it from your employer.

- Enter Personal Information: Fill in your personal details at the top of the form, including your name, PAN (Permanent Account Number), residential address, contact number, and email address.

- Provide Income Details: In the section labeled “Part A: Income Details,” provide information about your income from various sources during the financial year.

- Declare Investments and Deductions: In the section labeled “Part B: Declaration,” declare your investments and deductions claimed under various sections of the Income Tax Act.

- Attach Supporting Documents: Attach copies of relevant documents such as Form 16 (TDS Certificate), bank statements, rent receipts, interest certificates, investment proofs, etc., to support the income and deduction details provided.

- Sign and Date the Form: Sign and date the form at the bottom to certify the accuracy of the information provided.

- Submit the Form to Your Employer: Submit the completed Form 12C along with supporting documents to your employer within the specified deadline. Your employer will use the information provided to calculate the tax deducted at source (TDS) from your salary.

- Keep a Copy for Your Records: Retain a copy of the filled-out Form 12C and supporting documents for your records. This will be useful for reference during tax filing and for any future correspondence with tax authorities.

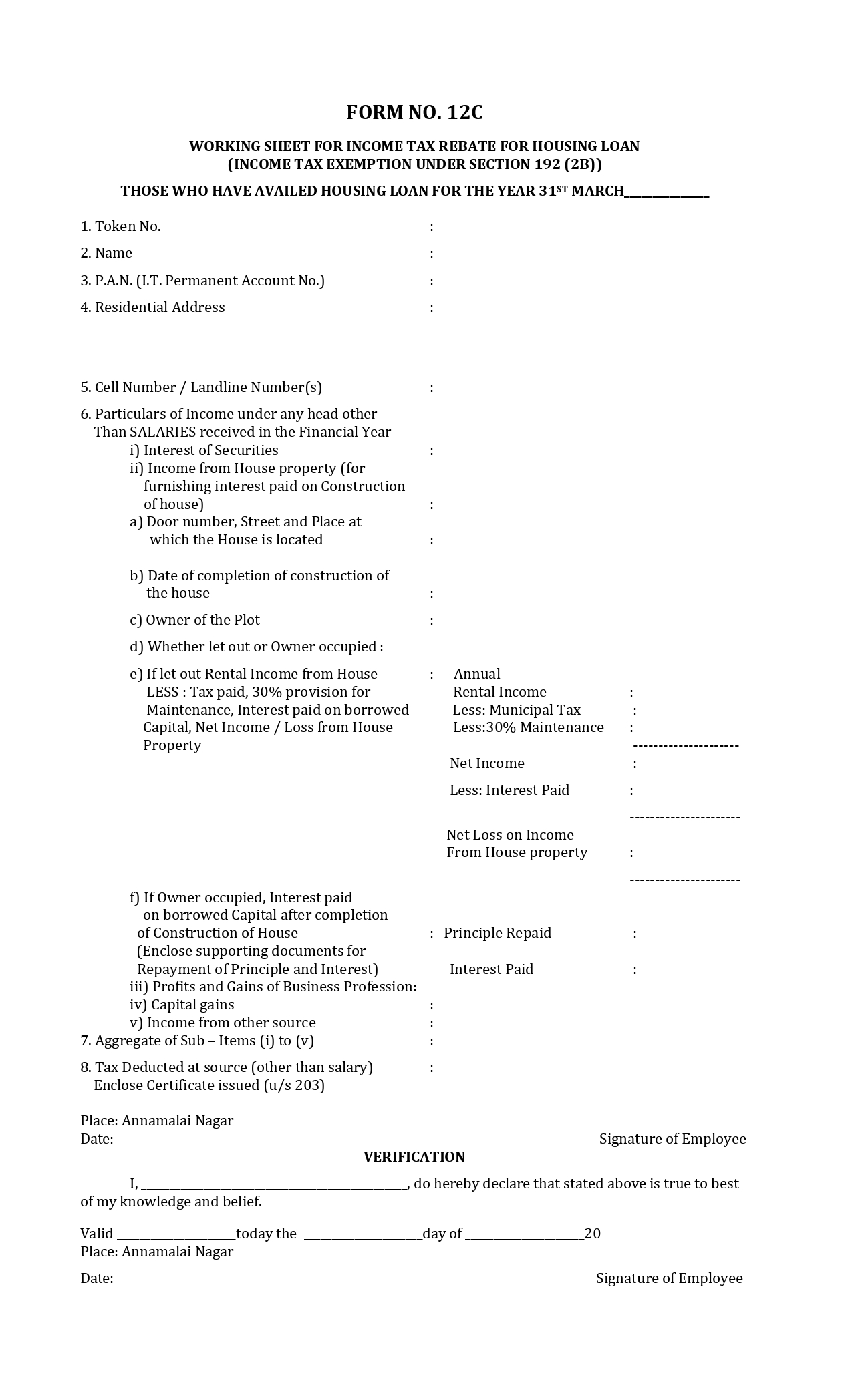

Form 12C Sample

Note: Form 12C has been discontinued and is no longer available for use. It is not listed on the IRS (Internal Revenue Service) website.