What is Salary Increment?

A salary increment is a percentage or a fixed amount of money added to employees’ compensation on a quarterly, semi-annual, or annual basis as a reward or recognition of their performance for a specific work period.

It can be a fixed amount or a percentage increase over the current salary and is typically communicated through an official salary increment letter or a revised payslip. The added amount is calculated based on the employee’s basic salary; however, companies often display the increased amount as part of allowances rather than adding it to the basic salary, especially when the basic salary accounts for 30% to 50% of the total CTC. Nowadays, Ai based payroll solution and and associated compensation calculation tools help management measure the increment percentage.

According to Deloitte, the growth rate in India’s private sector was expected to decrease from 9.4% in 2022 to 9.1% in 2023.

Meanwhile, Aon’s 2024–25 survey shows salary increases averaging 9.2%, a slight dip from the 9.3% reported in the previous cycle.

How to Calculate Salary Increment Percentage

Let’s calculate the salary increment and gain a detailed understanding.

if an employee earns ₹5,00,000 per annum. It is considered their CTC. According to the rule, the basic salary must be between 30% and 50% of the CTC. So, let’s assume the yearly basic salary is 50% of ₹5,00,000 = ₹ 2,50,000.

The employee now receives a 10% increase, which is applied to their basic salary. So the basic increase to

₹ 2,50,000 + ₹ 2,50,000 * 10 /100 = ₹ 2,75,000

So, now the basis is ₹2,75,000. According to the basic HRA, EPF, and other allowances, improvements are expected.

Here, employees should have a basic understanding of the components directly related to compensation.

First is the CTC, then comes the gross salary, then the net wage, and finally, the take-home salary.

CTC

CTC means cost to company. It includes the overall amount that employers must pay to their employees yearly. It includes gross salary, allowance, basic salary, deductions, HRA, and other relevant components.

Gross Salary

The gross salary is the total earnings of an employee, including commissions, tips, incentives, dividends, interest, and other forms of compensation.

Net Salary

The net salary is the amount of income remaining after deducting all applicable deductions from the gross salary.

Take-Home Salary

The take-home salary is equivalent to the net salary.

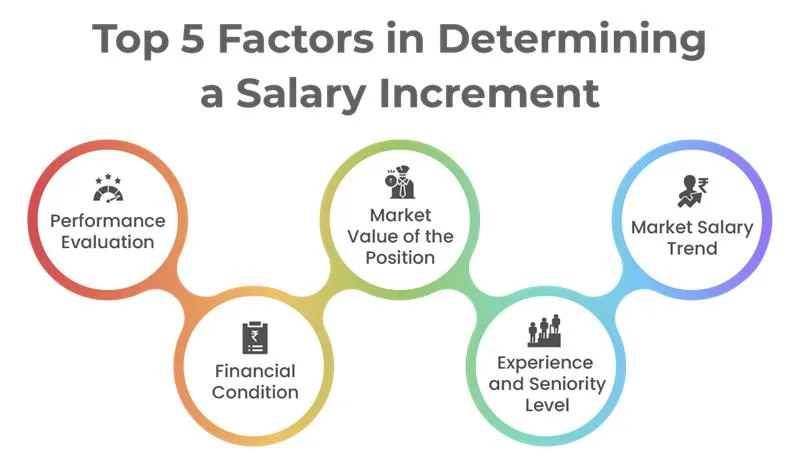

Top 5 Factors in Determining a Salary Increment?

While every employee naturally looks forward to a rewarding salary hike each year, employers must take a thoughtful approach—evaluating key factors, understanding their impact, and analysing them carefully—to ensure the increment decision is fair, data-driven, and aligned with both performance and business goals. Here are the following factors,

1. Performance Evaluation

Relying solely on verbal feedback from managers is becoming outdated in today’s data-driven work environment. Instead, organisations can leverage performance tracking tools and dedicated evaluation software to assess employee contributions on a quarterly, half-yearly, or annual basis.

In recent high-build HRMS software, employees can also participate in a self-evaluation process using the ESS portal. It not only enhances transparency but also promotes accountability and engagement.

2. Financial Condition

Employees expect a sound increment in every salary hike, regardless of whether the company’s business is financially successful. However, before finalising the incrementation process, it is the responsibility of the management team to review the company’s financial condition and analyse its position and growth in relation to economic statistics. In such cases, employers should hold a couple of meetings with the financial advisors or the financing team regarding their opinions.

3. Marketing Value of the Position

Before finalising the salary hike, employers should analyse the marketing value of the position. Let’s discuss this with an example. Suppose there is an employee or a group of employees in a particular domain whose market value is diminishing over time.

Instead of continuing to offer salary increments for employees in that domain, management should make informed decisions to provide them with appropriate training by knowing their concerns, transferring them to a different domain, evaluating their performance there, and then considering arranging increments accordingly.

4. Experience and Seniority Level

Employees with greater experience may be eligible for a significant salary increase. A professional, acknowledged for their skills, is beneficial to an organisation in terms of job performance improvement and greater efficiency. They can also take on more complex responsibilities to enhance the business.

5. Market Salary Trend

Before implementing a random salary hike, the employers need to analyse the salary-based market trend, both regionally and worldwide. According to market trends, some domains have become overhyped recently, while others remain under the radar.

Let’s take an example,

Now, the innovation of AI makes a huge difference in work trends. The way of working with domains like digital marketing and marketing has undergone dramatic changes. On the other hand, some domains of the engineering field are constant to this day. Employers should have a clear understanding of domain popularity before investing a substantial amount in a compensation hike.

Tips for Negotiating a Salary Increase with an Employee

Every year, multiple organisations plan for employee salary increments, whether based on financial considerations or calendar year. However, before implementing the salary hike, employers should select the deserving candidates to maintain proper transparency within the workplace.

Often, employers also face some critical moments where good employees resign their positions due to not receiving the expected salary. Management not only loses its talents but also affects its productivity. Instead of considering random salary hikes, a few essential negotiation tips can help employers identify and choose the right employees for salary revisions. Those are,

- Track employee performance throughout the year, rather than focusing only on the prior months, before initiating the increment process.

- Identify the talents before they reach out to the employers to complain about an unsatisfactory salary hike.

- Before initiating the salary increment process, schedule a one-on-one meeting to discuss the financial details in person.

- Ask about their expectations; if it is beyond your budget, discuss the situation with them. Maintaining transparency leads to employee satisfaction.

- Assist employees in understanding the reasons behind the approval or disapproval of the increment.

- Reach a conclusion that is fair for the employees and employers.

- If a salary hike is announced for many employees, and you fail to arrange a one-to-one discussion, try to reach out via email to discuss their expectations at least.

FAQs on Salary Increment

1. How to calculate the Salary Increment percentage

(New Salary – Old Salary) / Old Salary) * 100 = Increment %

2. What is the 30% Increment in Salary?

A 30% salary increment means that if your current salary is 1000 per month, it will be increased by 30%. After increment, it will become 1000 + 1000* 30/100 = 1300.

3. What is the government’s Salary Increment

According to ddnews.gov.in, blog.madeeasy.in, and hindustantimes.com, in 2024–25, the Indian government raised the Dearness Allowance (DA) for central employees twice: first to 53% in July 2024, and then to 55% in March 2025—each hike by 2%.

While basic pay remains unchanged until the 8th Pay Commission’s recommendations, the DA increases are fully taxable and directly boost take-home pay and retirement benefits by aligning compensation with inflation.