Full and Final Settlement (FnF)

As Full and Final settlement is the financial closure between employees and employers, it occurs after their employment ends with a company. It helps in the calculation and payment of final salary, based on unused leaves, bonuses, and other statutory benefits, while also accounting for any outstanding deductions or recoveries of company assets. Hence, it is beneficial for both the employees and the employers, concluding their relationship on a positive note.

Full and Final Settlement Guide

What is Full and Final Settlement?

Full and Final Settlement (FnF) is the process of calculating outstanding dues to an employee who is leaving the organization, either due to resignation, termination, or retirement, and paying them within two working days. It ensures that all dues are cleared, including salaries, bonuses, incentives, etc., ensuring that all financial obligations are settled.

FnF provides a seamless exit for the employees, as the New India Labour Codes require companies to share the remaining amount, such as salary, bonus, leave encashment, etc., within 2 working days from the last working day of the employee. With the help of robust payroll software, they can pay the exact amount, resulting in satisfied employees and enhancing the company’s image.

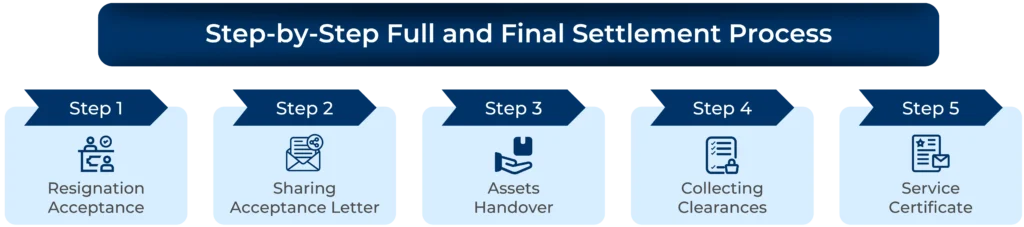

Step-by-Step Full and Final Settlement Process

The process of Full and Final Settlement is conducted according to the specifications of the company’s policies. A general flow of the FnF Settlement Process is:

Step 1. Resignation Acceptance

Accepting the employee’s resignation is the first step of the full and final settlement process in which the company accepts the request of the employee to leave the organization. It can be undertaken easily with the help of a ESS portal within modern HRMS software.

Step 2. Sharing Acceptance Letter

After receiving the resignation letter from the employee, the employer sends an acceptance letter to acknowledge the exit date and commence the process of full and final settlement accordingly.

Step 3. Assets Handover

The next step is the handover of all official gadgets and access cards provided to the employee during their term of employment with the organization. The employees are expected to return the assets intact along with any credentials.

Step 4. Collecting Clearances

Different departments like IT, HR, Finance, and Admin provide clearances after verifying the recoverable from the employee. It ensures zero data theft and maintains the confidentiality of the company.

Step 5. FnF Settlement Letter & Service Certificate

After getting the required clearances, the full and final settlement is processed and released within 30-45 days of the employee’s exit. Additionally, an experience certificate is also provided to the employee for investing their knowledge and skills in the company.

What are the New Rules for FnF Settlement?

India’s New Labour Codes, 2025, enacted the Code of Wages, 2019, which states that all dues for employees who are exiting an organization – due to resignation, retrenchment, firing, or closure – should be paid within 2 working days of their last working day. It proves to be a major reduction from the current practice of paying employee dues after multiple weeks.

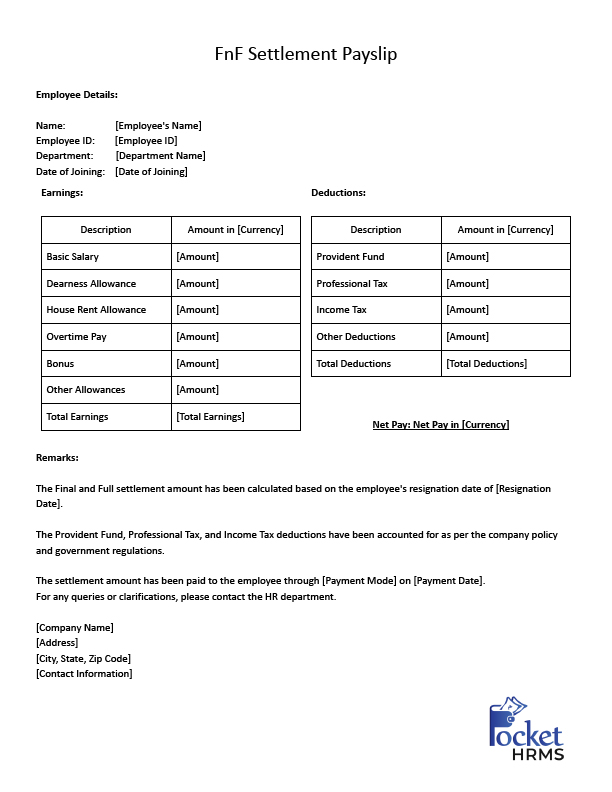

Full and Final Settlement Format

The FnF settlement format for payslip does not have any specific format to be uniformly followed by all the establishments.

Full and Final Settlement letter

FnF Settlement Calculation

The FnF is calculated by adding multiple components of FnF, such as final salary, leave encashment, pro-rata bonuses and incentives, gratuity, and other reimbursements, if required. Similarly, deductions such a TDS, loans, etc. are removed from the sum derived to arrive at the final amount, which is disbursed to the employee.

The FnF settlement is calculated by summing up all outstanding dues, like:

- Unpaid salary = days worked * gross salary / 26

- Leave encashment = unused leaves * daily basic salary / 26

- Pro-rata bonuses

- Gratuity = (last drawn salary x 15 x years of service) / 30

- Reimbursements.

The calculation also involves the subtraction of various amounts the employee may owe the company, such as:

- TDS

- Outstanding Loans

- Outstanding Salary Advances

- Asset recovery charges

- Other dues, if any.

FAQs on Full and Final Settlement

When is Full and Final Settlement Required?

The full and final settlement is required at the time of termination of employment. It ensures that the employees are paid their financial dues, such as final salary, bonuses, incentives, leave encashment, etc., while also recovering assets and any fines incurred.

What is the maximum time for Full and Final Settlement?

The New Labour Codes, 2025 mandate that employers should complete the full and final settlement of an employee within 2 working days after their exit from the company.

What is the Full and Final Settlement time period?

The full and final settlement time period is the time within which the employer is liable to clear the dues and obligations of the exiting employees last working day to settle their FnF.

What is the full form of FnF?

The full form of FnF is full and final settlement. It refers to the process to clear the dues of employees which includes their salaries. unused paid leave encashments, bonuses, compensations, deductions, etc.

Is Gratuity paid in Full and Final Settlement?

Yes, gratuity is included in the full and final settlement. It is a major component that is evaluated in the process of fnf. Under the Payment of Gratuity Act, of 1972, Gratuity is paid to employees who have completed 5 years of continuous term in an organization without any gap in between. Most companies deduct 4.81% from the employee’s salary and pay it during the exit of an employee as the gratuity amount.

What are the clearances required to process FnF?

To process FnF, employees need to get clearances from different departments, including:

- HR team for notice period completion, exit interview, etc.

- Finance team for final settlement calculations, including salary, bonuses, etc.

- IT team for IT-related assets like laptops, accessories, etc.

- Administrative team for company assets like ID cards, access cards, etc.

What are the documents required during FnF Settlement?

The documents required during FnF settlement include:

- Resignation Letter

- Acceptance Letter

- Employment Letter

- Form 16

- Previous Payslips

- No Dues Certificate

- Reimbursement Claim Forms

- Asset Return Record

- Handover Form

- FnF Settlement Statement

Does FnF include last month's salary?

Yes, FnF includes last month’s salary. It includes the pro-rata salary for the exact number of days worked in the final month of employment.